Coverage continued from Part 1.

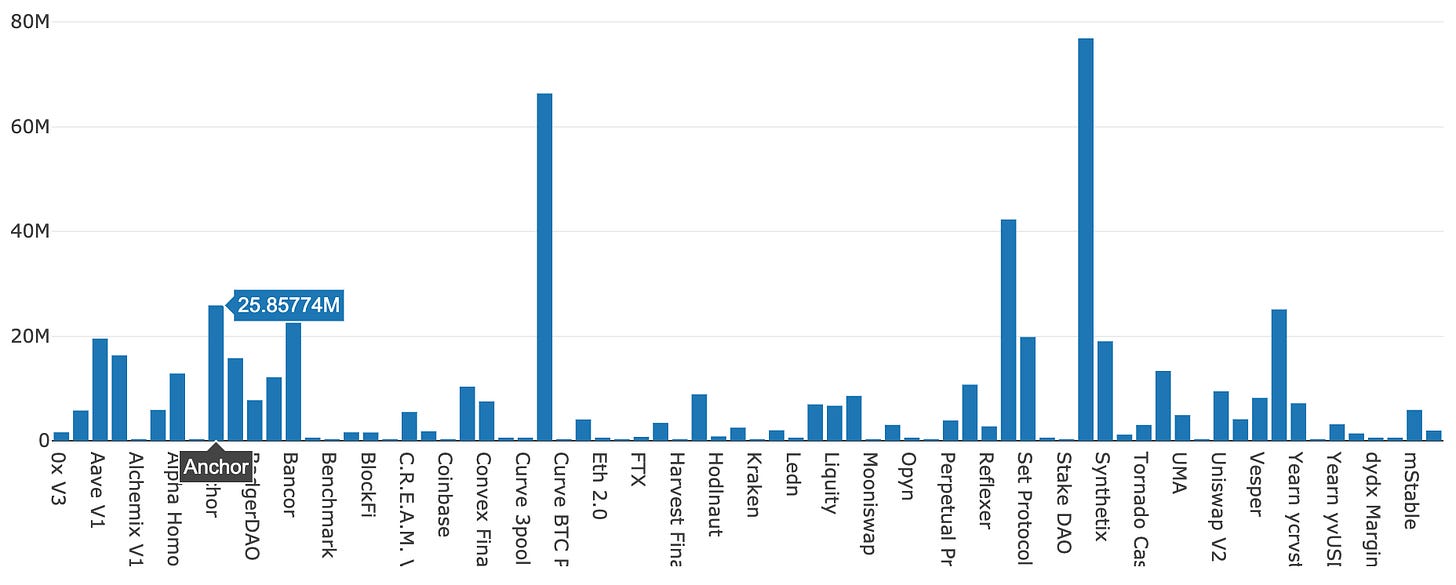

With protocol cover, Nexus is covering more projects on other chains outside of Ethereum L1. Anchor Protocol has been a popular source of cover purchases (with $25M in active covers), as APYs are still around 20% when stablecoin yields have come down across the board on Ethereum.

Nexus recently invested 10% of the capital pool into Lido stETH to earn yield on the capital pool. Right now, Nexus is the fourth-largest holder of stETH. The mutual earns around 2.4 ETH per day and has earned 181 ETH since late May.

⑤ PoolTogether

👥 Leighton Cusack

📈 Over $4 million in no loss prizes awarded

👉 Community Discord 📌 Job Board 🔎 Dashboard

PoolTogether is a protocol for no-loss prize savings. Users deposit money to have a chance to win prizes and can withdraw their money at any time. Prizes are comprised of the interest accrued on all deposits. A key metric for the protocol is total prizes awarded, over $4 million in prizes have been awarded in the last 6 months. The luckiest winner deposited $73 and won $43,760.

A portion of each prize is retained in the protocol reserves. In the last 4 months the protocol reserves have grown from $0 to ~$1 million. All reserves contribute interest to future prizes increasing the expected value for all depositors.

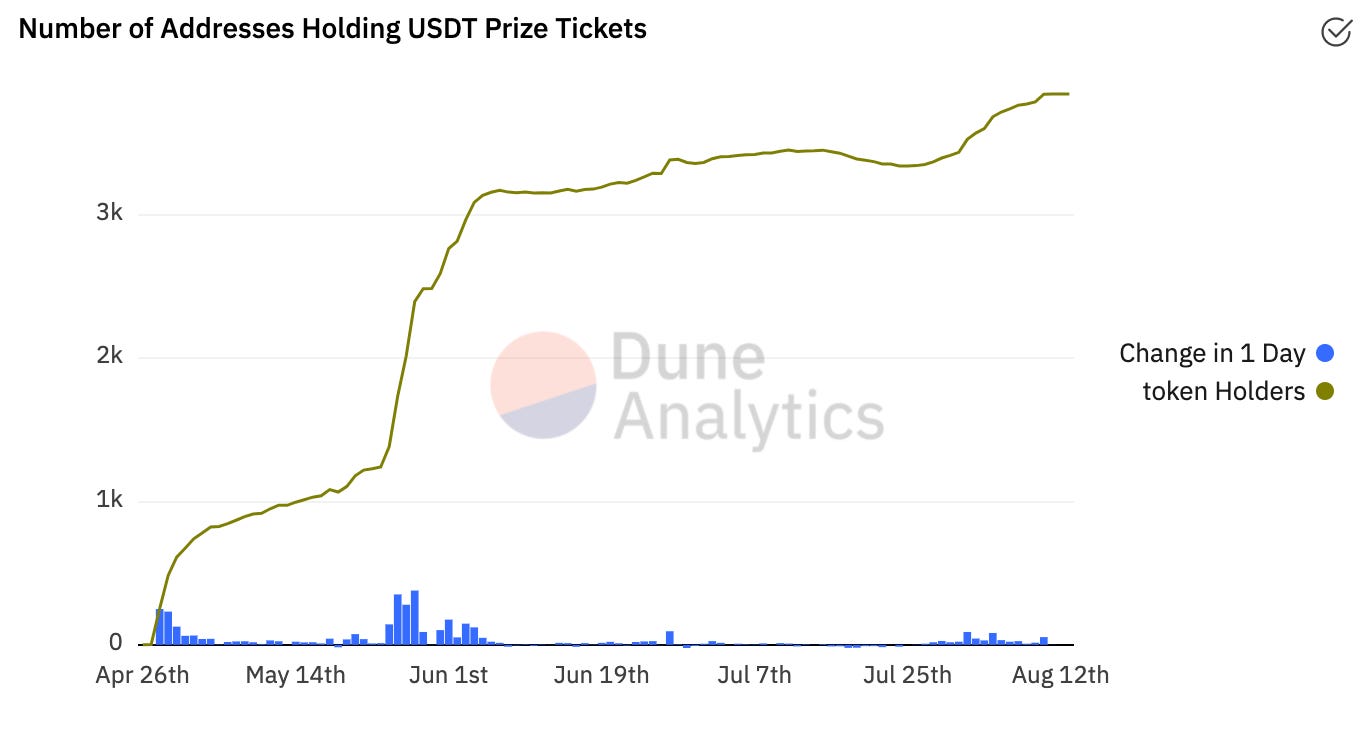

The first prize pool deployed on Polygon has shown the importance of low transaction fees. This prize pool quickly grew to be the second-largest pool measured by unique depositors (3,846). The protocol is currently deployed to Ethereum, Polygon, and Binance Smart Chain.

⑥ SushiSwap

👥 Lucas Outumuro

📈 SUSHI projecting $60 million revenue, P/E drops

👉 Community Discord 🗳️ Governance 🔎 Dashboard

SushiSwap has quickly established itself as a main player in DeFi. It has integrated into 11 different blockchains and launched new features aside from its DEX. These use-cases include lending (Kashi), IDOs (Miso), and an upcoming NFT marketplace (Shoyu), thusshowcasing SushiSwap’s ambitions to become a DeFi super app. In terms of its core DEX product, activity across several key indicators has recovered, and it’s also soon to launch a new capital efficient DEX called Trident.

SushiSwap’s liquidity between its two main chains (Ethereum and Polygon) has rebounded by over 50% in the past month. In spite of growing competition, total liquidity supplied for the protocol remains above $4 billion and is within 30% of its previous all-time high. Trading activity and revenues have also been on an uptrend recently.

SushiSwap is projecting $60 million for xSUSHI stakers. Taking these as the protocol’s earnings, this would give SUSHI a P/E ratio of 38.5, which is significantly lower than Coinbase’s 160 P/E. SUSHI's P/E has been declining while SUSHI’s price has been increasing, getting cheaper relative to its revenues.