Our Network: Issue #84

Coverage on PERP, SUSHI, DYDX, POOL, and NXM.

About the editor: Spencer Noon is an investor at Variant, an early-stage crypto VC fund.

Fundraising or looking to start a career in crypto? Reply to this email and introduce yourself.

👾 NFT Fundamentals

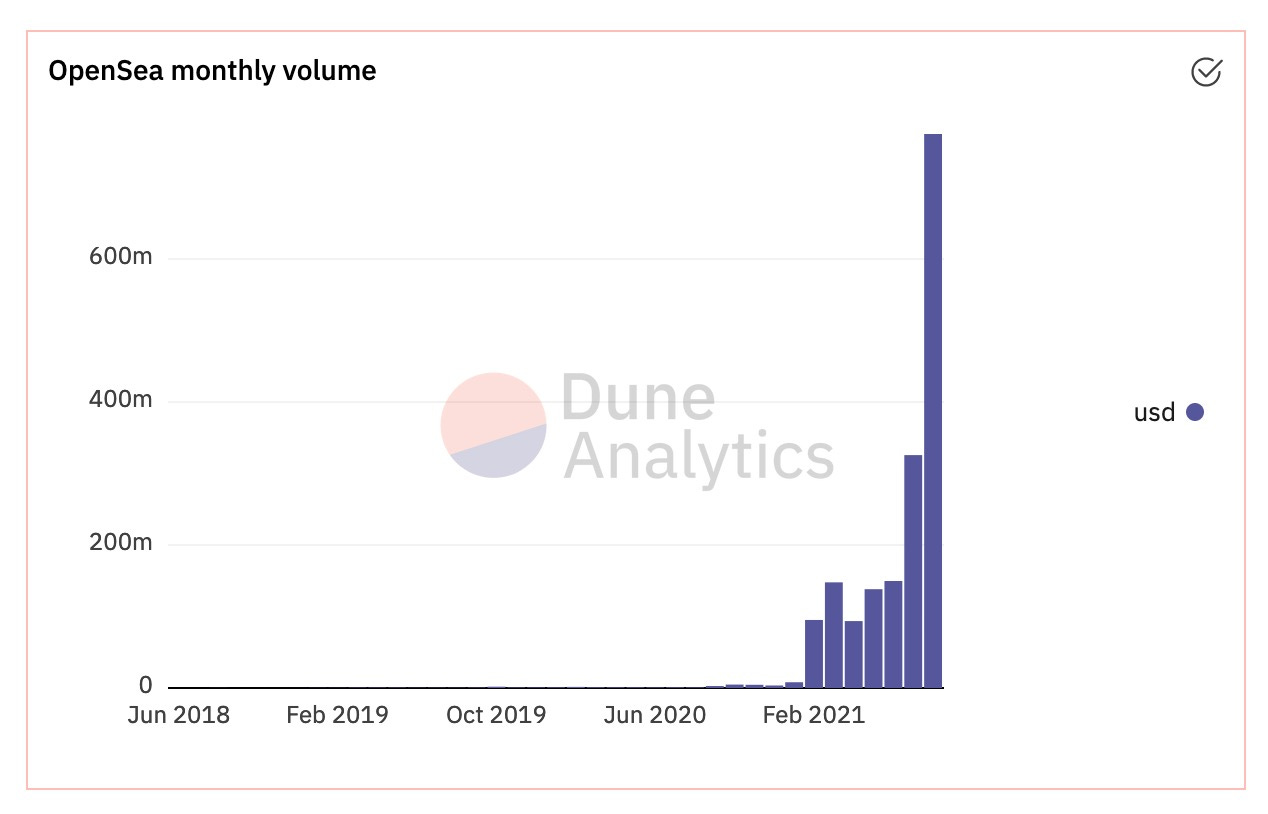

Over the last few weeks, the NFT ecosystem has ratcheted up to levels that even I doubted we’d see so soon. Pudgy Pengins (not a typo) was just featured in the NYT, the cheapest CryptoPunk to buy is now $145K, and OpenSea—with $775M in volume this month after just 13 days—is on pace to do more volume in August than all other months combined. This is unbelievable!

As with every new hype cycle in crypto, we’re seeing incredible price appreciation across the board, sometimes for assets that don’t appear to have any fundamental (or artistic or cultural) value whatsoever. This can be overwhelming at times, so to help investors make a bit more sense of it all, I decided to aggregate a list of my favorite indicators that I personally use to evaluate NFT projects:

If you’re interested in the NFT space, I’d love to hear your feedback on the indicators listed here. Also feel free to suggest your own. Finally, expect us to start covering more NFT projects on Our Network in the coming weeks.

Switching gears—this week our contributor analysts cover DeFi: PERP, SUSHI, DYDX, POOL, and NXM.

① dYdX

👥 Corey Miller

📈 dYdX volume surges 650%: now largest perpetuals DEX

👉 Community Discord 📌 Job Board 🔎 Dashboard

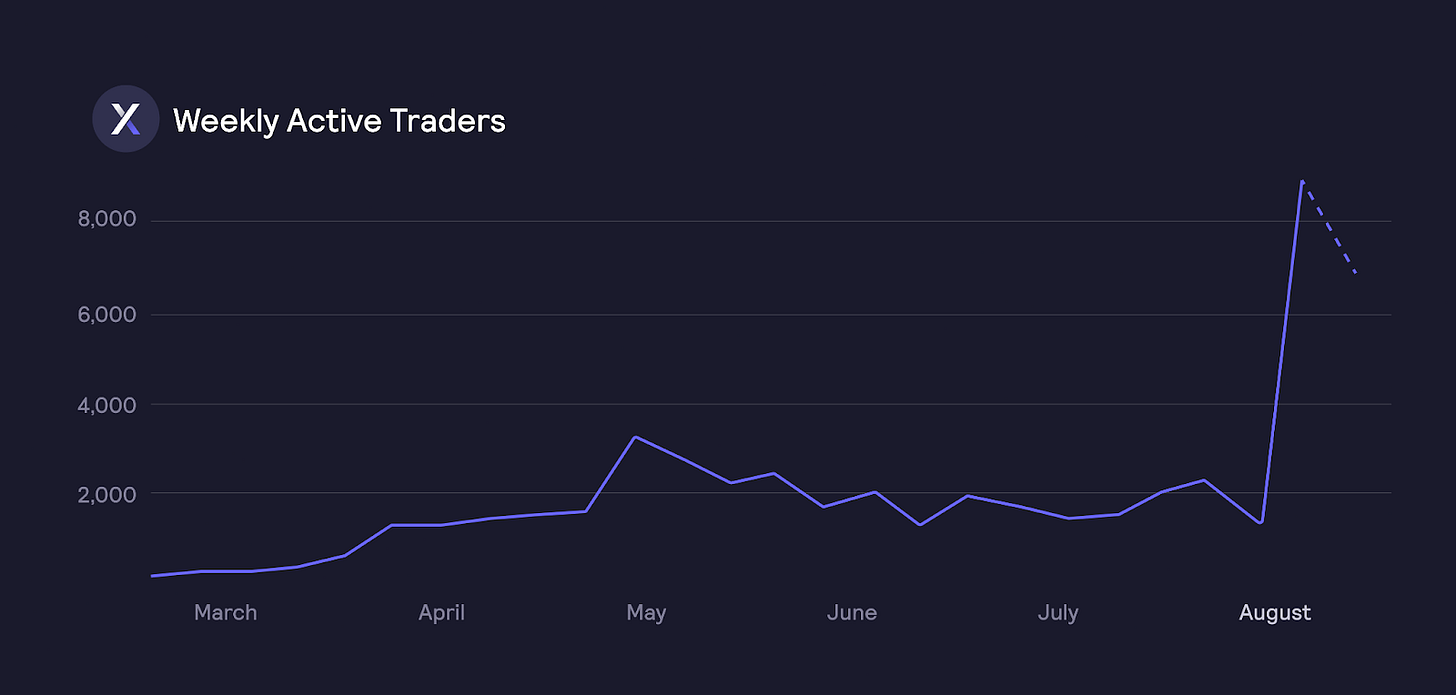

On August 3, the dYdX Foundation launched DYDX, a governance token for the dYdX Layer 2 protocol. The launch included multiple pools to incentivize liquidity and trading on dYdX across makers and takers: Retroactive Mining Rewards, Liquidity Provider Rewards, Trading Rewards, Liquidity Staking, and Safety Staking. Since launch, dYdX has quickly become the top decentralized perpetuals exchange by volume (>$1B weekly volume) and the top Layer 2 by TVL (currently at $209M).

Over $108M USDC across 400+ stakers is now being staked in Liquidity Staking Pool. This pool functions as a zero-interest, uncollateralized loan to known market makers governed by the dYdX Community. This capital will be used by market makers to continue to bolster liquidity on dYdX order books.

Weekly active traders on the network increased 635% to a total of 8,784 unique addresses. This has been largely driven by the Retroactive Mining and Trading Rewards Programs, which incentivizes 64,306 historical users of dYdX to onboard onto the L2 protocol and start trading.

② Perpetual Protocol (Part I)

👥 0xminion

📈 Total protocol volume nearly crossing $23B

👉 Community Discord 📌 Job Board 🔎 Dashboard

There is renewed interest in the on-chain derivatives space with the recent regulatory crackdown on derivatives trading. Perpetual Protocol’s unique daily trader count has been trending up since its mainnet launch. It experienced a significant spike in numbers during the recent market downturn in May, but while daily volumes afterward have been slightly lower, unique daily trader count has showed no signs of slowing down.

With the low gas fee on xDAI, most users are high-frequency traders with a volume share of 90% of the total. However, medium-frequency traders' share has been growing fast in the past 60 days. We are seeing new low- and medium- frequency traders (i.e., retails) beginning to experience Perpetual Protocol.

The protocol has collected nearly $23M in revenue, with an average of ~$9K revenue/trader. On average, each trader makes 1600 trades and contributes $5.39 in fees per trade. Comparing the recent two months of stats, each trader made roughly 1300 trades and contributed just above $4 per trade.

③ Perpetual Protocol (Part II)

👥 Lewis Harland

📈 55% of PERP circl. supply is now being put to work

Perpetual Protocol has facilitated $23B in trade volume to date. As futures take flight within DeFi, a more interesting question is: how much of the perp swap market has Perpetual Protocol taken over time? For the high-cap names, Perpetual Protocol took 0.2% and 0.05% market share at its peak for ETH and BTC respectively before declining in line with trading volumes. DeFi assets have been taking larger market shares overall. DeFi asset perpetuals are finding product-market-fit in DeFi itself.

Perpetual's vAMM design means OI is not capped by liquidity provided. This has likely been a key driver for Perpetual Protocol's volume dominance over other perpetual swaps to date. It’s worth noting, however, that the announcement of the dYdX liquidity mining programs has led dYdX volumes to overtake Perpetual's by the widest margin.

Perpetual Protocol losses are directly backed by its 4m USDC insurance fund and indirectly by PERP stakers. Stakers who shoulder the risk of the fund being depleted have now committed 24.3m PERP (~$380m), equating to 55% of the circulating PERP supply with the majority of PERP tokens now being put to work.

④ Nexus Mutual

👥 Richard Chen

📈 Nexus most undervalued project in DeFi insurance

👉 Community Discord 📌 Job Board 🔎 Dashboard

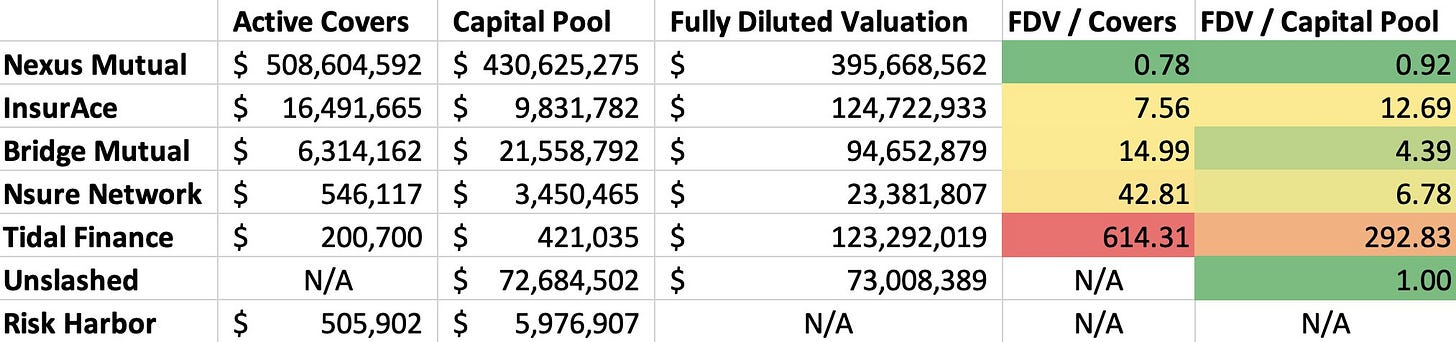

The table below compares all the projects in the DeFi insurance space that have live products. Nexus Mutual has by far the most active covers and the largest capital pool, yet is still the most undervalued relative to its fully diluted valuation when compared against the two insurance KPIs.