Continued from Part 1.

④ DODO

Contributor: Diane Dai, Co-founder at DODO Exchange

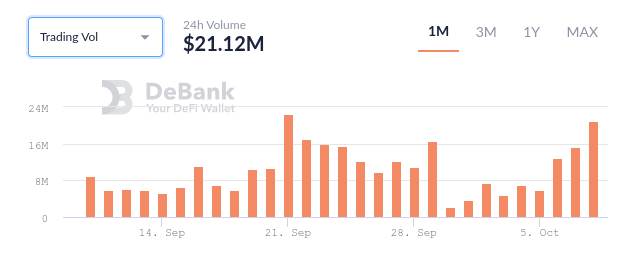

DODO is a nascent liquidity protocol that is gaining popularity and traction among liquidity providers and traders alike. Two of the most important performance indicators for an on-chain liquidity provider like DODO are total value locked (TVL) and trading volume, as they directly measure the platform’s available liquidity, trader participation, and capital efficiency. After a brief dip in TVL and volume at the conclusion of the first iteration of the DODO Carnival community incentive programs, DODO has seen a rebound in both key metrics. As of October 8, DODO has $115.33M in TVL and $21.12Min 24-hour trading volume (Source).

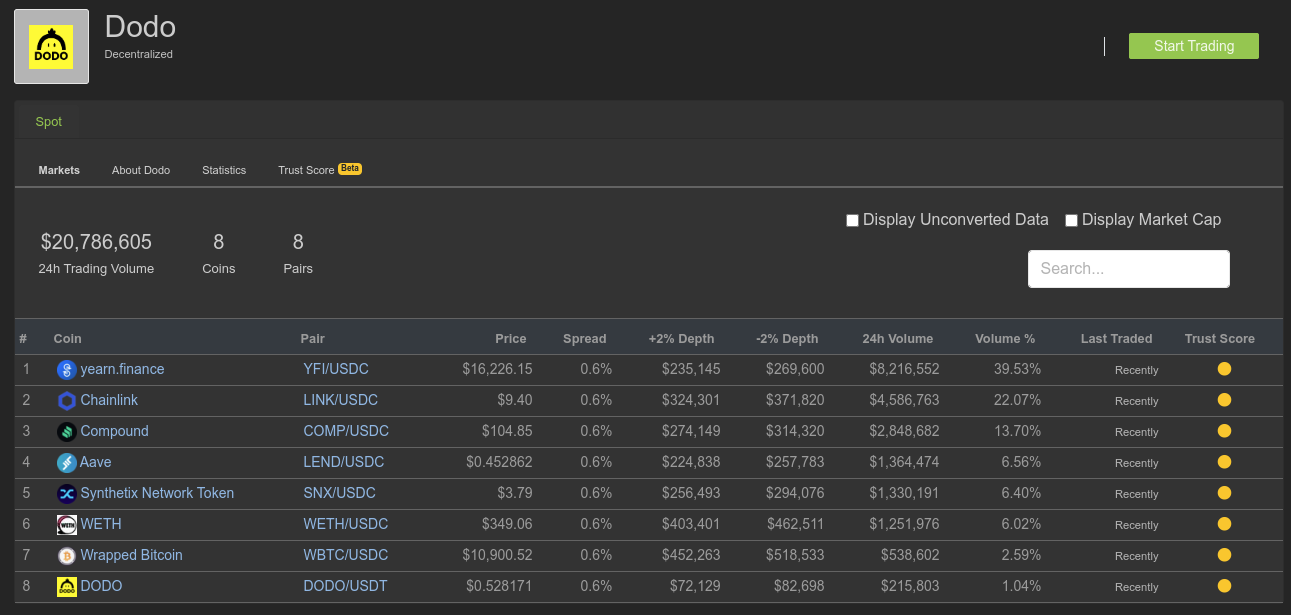

Liquidity providers are exposed to single-token risk on DODO, meaning they do not have to deposit tokens in pairs. In September, 3,122 wallet addresses participated in DODO’s Grey Parrot liquidity mining program, a significant increase from 388 early adopter wallet addresses in August, which include both traders and liquidity providers (Source). The YFI/USDC trading pair has the highest trading volume on the DODO Exchange, at more than $8M over 24 hours (Source).

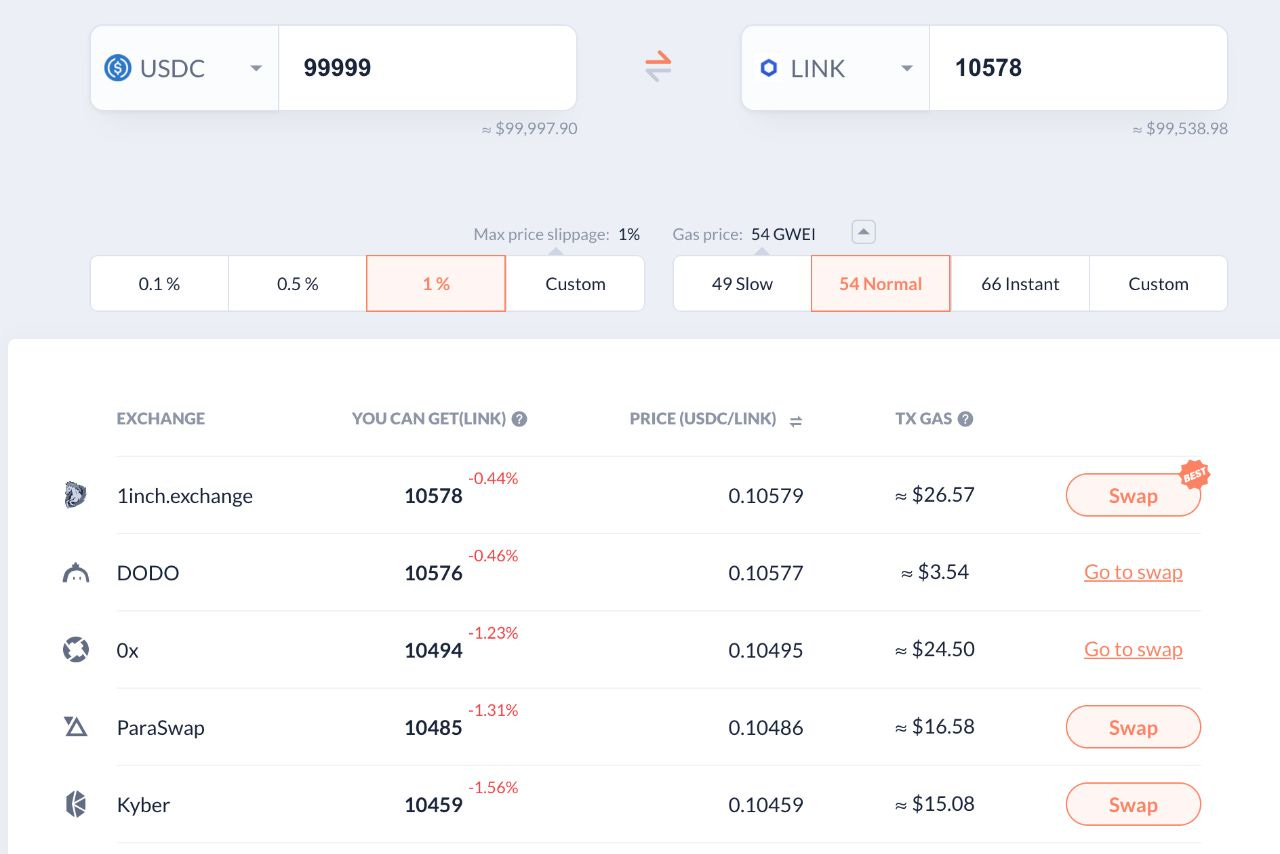

DODO’s proactive market making algorithm is capital efficient. Using the LINK-USDC trading pair below as an example, traders can get almost the best price and the lowest slippage at much lower gas fees compared to other DEXs (Source).

⑤ dYdX

Contributor: Brock Elmore, Co-Founder of Topo Finance

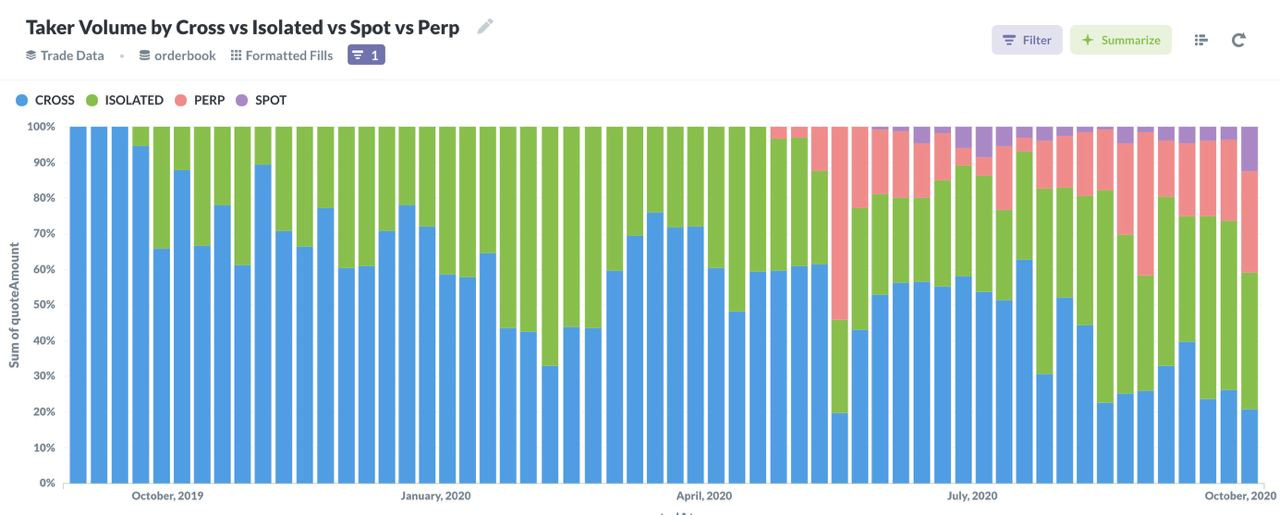

dYdX has expanded their offerings consistently since launch. Their longest-running offering is cross margin trading, but more recently the team has created perpetual contracts for BTC, ETH, and LINK. As shown below, their perpetual contract volumes have grown to a good portion of their volume.

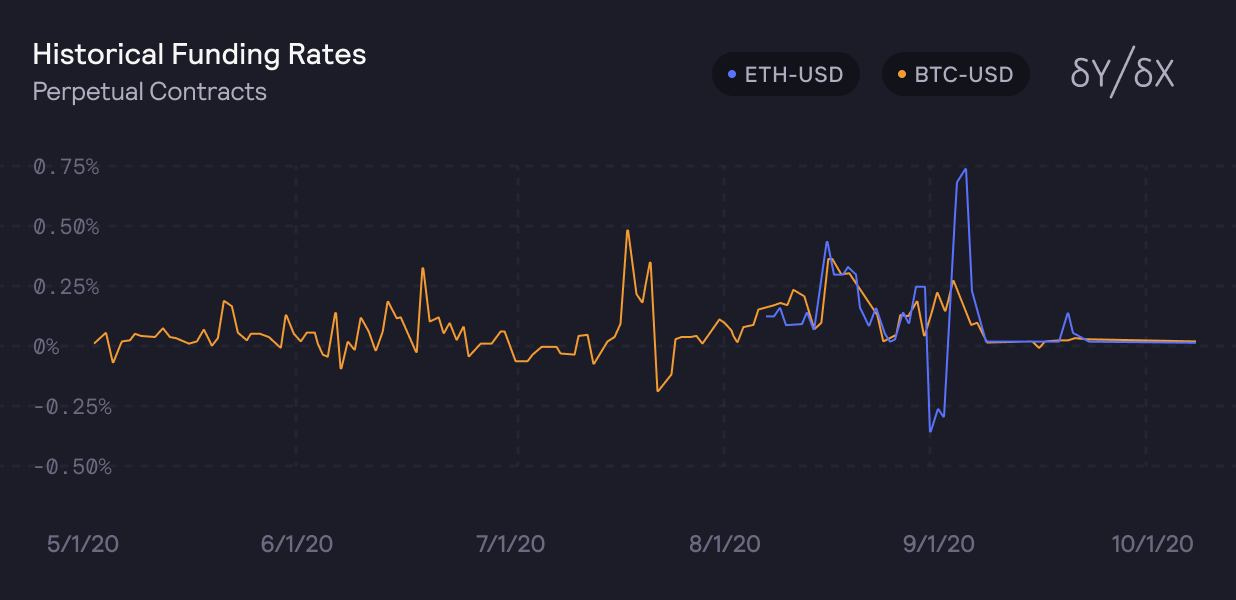

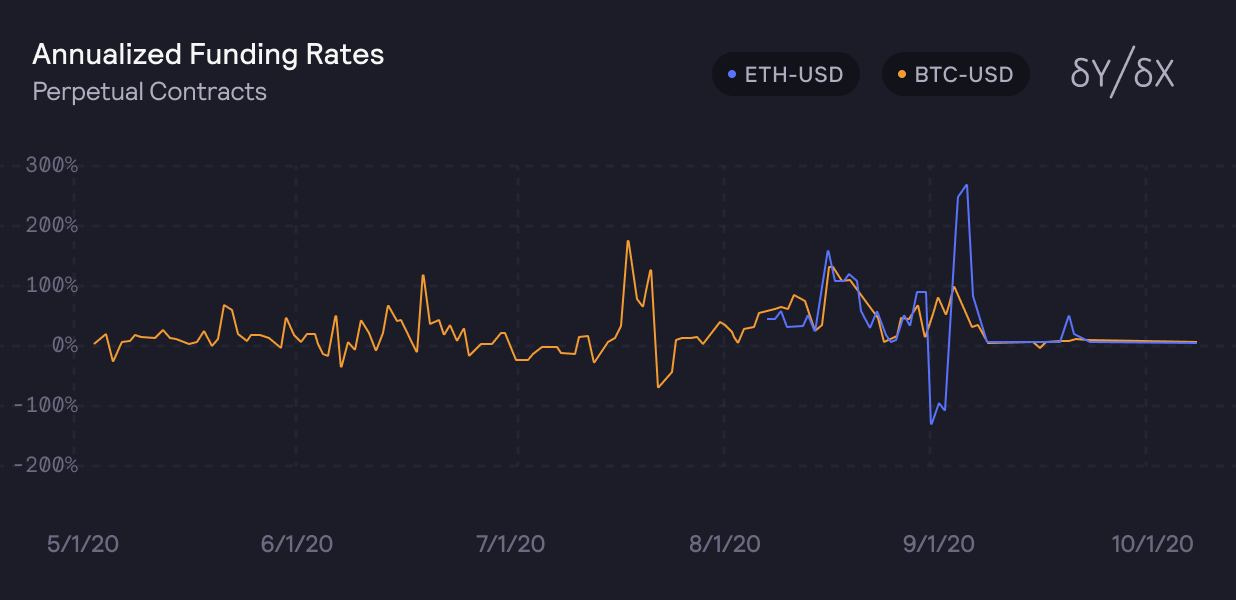

These perpetual contracts kick off interest for providing funds. This incentivizes participants to balance the order book, so as to keep the system healthy even in times of high volatility. These funding rates can often be consistently double digit returns (as shown below). The top graph shows the 8-hour rate with the bottom graph visualizing the annualized rate.

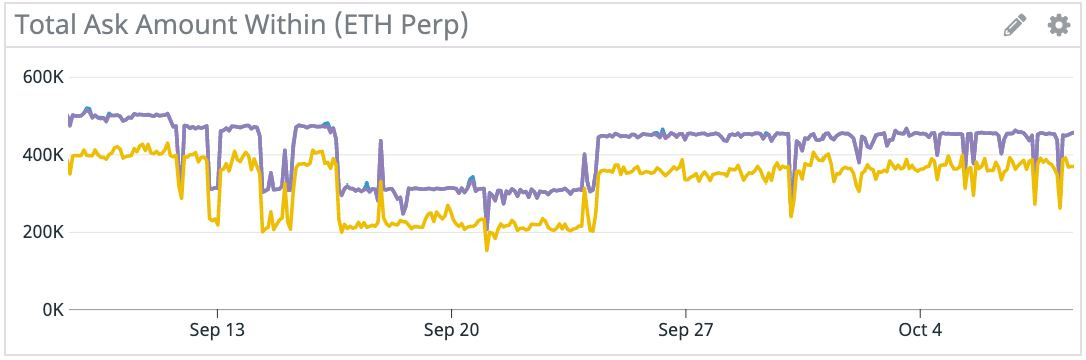

Ultimately, what matters for an exchange is the liquidity that traders can access. This is where an off-chain order book with on-chain settlement, like what dYdX does, can shine. In the chart below, the purple line denotes how much liquidity is available within 50 bps and the yellow line within 25 bps of mid-market price. What this shows is that you can place a $400k market buy and experience around 35 bps of slippage.

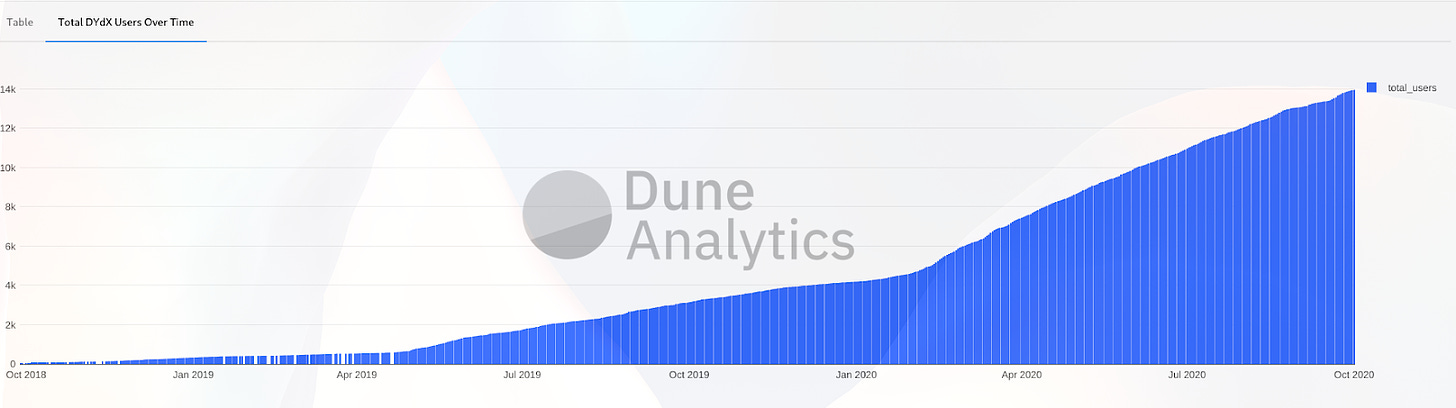

Lastly, dYdX has been steadily growing in the number of users. They are nearing 14k users, having steadily increased since launch and picking up speed since the start of their perpetual contracts. (Source).