This is issue #42 of the on-chain analytics newsletter that reaches 5500 crypto investors every week 📈

Data-Driven Crypto Jobs

Analysts, researchers, and other members of the Our Network community are increasingly reaching out to me in search of opportunities to work in the space. To that end, I am going to start posting a list of high-quality, data-driven crypto jobs in this newsletter once per quarter moving forward.

Here are some of the best open roles available now:

This week our contributor analysts cover DeFi: Uniswap, 1inch, DODO, Kyber, and dYdX.

① Uniswap

Contributor: Teo Leibowitz, Strategy Lead at Uniswap

With 74% trading protocol market share, automated liquidity protocol Uniswap is now regularly surpassing Coinbase on daily volume. Between September 28 — October 4, Uniswap saw $811m of volume across ETH-USDT, ETH-USDC, and ETH-DAI versus Coinbase’s $322m across ETH-USD, ETH-GBP, and ETH-EUR. Coinbase continues to outperform on a volume basis across longer-tail assets like OMG, OXT, and BAND by an average margin of 98%.

Source: Dune Analytics

Uniswap continues to see user growth: the week of September 14 saw an all-time high of over 145,000 unique users, while the subsequent two weeks each saw over 120,000 unique users, a growth rate of 21% versus the first week of September. Over 1 million swaps have taken place in four out of the last five weeks, with an average trade size of $923. Uniswap users spent over $12.7m on gas over the past 30 days, the highest volume of any Ethereum-based smart contract.

Source: Dune Analytics

Uniswap currently offers the largest capital base of any DeFi protocol, with $2.4bn liquidity now locked across 13,400 pools. 25% of WBTC outstanding supply (~$259m) is being provisioned as liquidity on Uniswap v2. The ETH/UNI pool currently supports the highest number of unique LPs (4,970) followed by ETH/AMPL (3,577) and ETH/DAI (3,239). Despite recent tempestuous price action, market creation growth shows no sign of abating, with all-time highs set in each of the past two weeks.

Source: Dune Analytics

Uniswap appears to be significantly more capital efficient than its AMM peers — Balancer and Curve. A 30-day-volume-to-liquidity ratio places Uniswap at 6.43 versus Curve’s 3.39 and Balancer’s 3.17.

Source: The Block, DeFi Pulse, Dune Analytics

② 1inch Exchange

Contributor: Nick Ovchinnik, CBDO at 1inch.Exchange

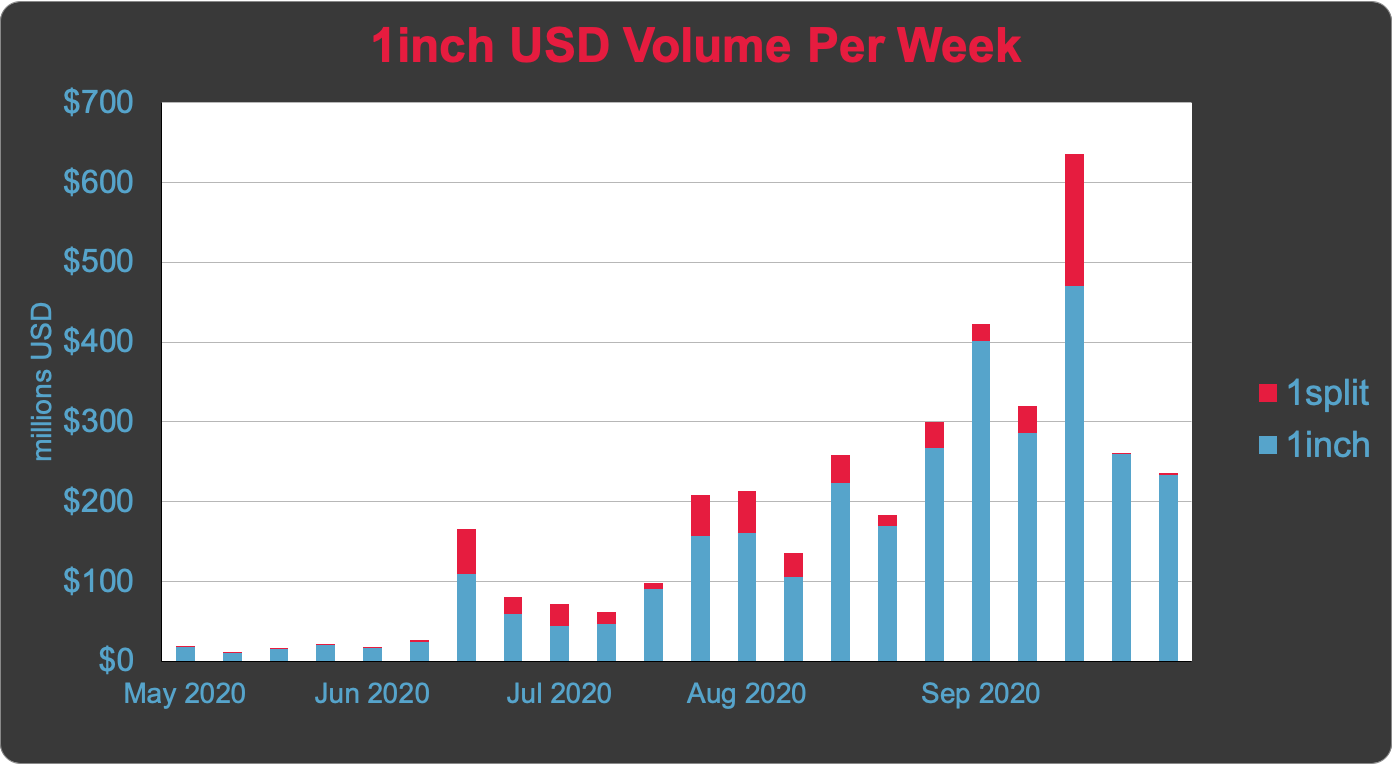

1inch.exchange trading volume is growing along with the DEX market, reaching almost $1.5 billion in September 2020. Since the launch, 1inch’s total transaction volume has surpassed $4 billion. Currently, 1inch accounts for 10% of the overall DEX trading volume; therefore, there is an opportunity for 1inch and other aggregators to capture a higher share of DEX trades. In addition, in September, 1split, our open-source smart contract that can be integrated by any dApp, wallet or individual user, grew significantly reaching its highest ever monthly volume of $222 million.

Recently, our protocol saw a significant increase in the number of active users. Over the months of August and September, the number of unique wallets swapping on 1inch increased by nearly 100% to a total of 29,110 as of October 7, 2020. Our website reports an even higher increase in visits and we expect to retain this growth rate in the coming months. We have just launched a new algorithm called Pathfinder, which helps to drastically increase transaction speed on 1inch. The new algorithm guarantees a response time of 0.5 seconds for the majority of crypto pairs, which allows users to maximize their trading profits by picking the best rates on different exchanges. (Source)

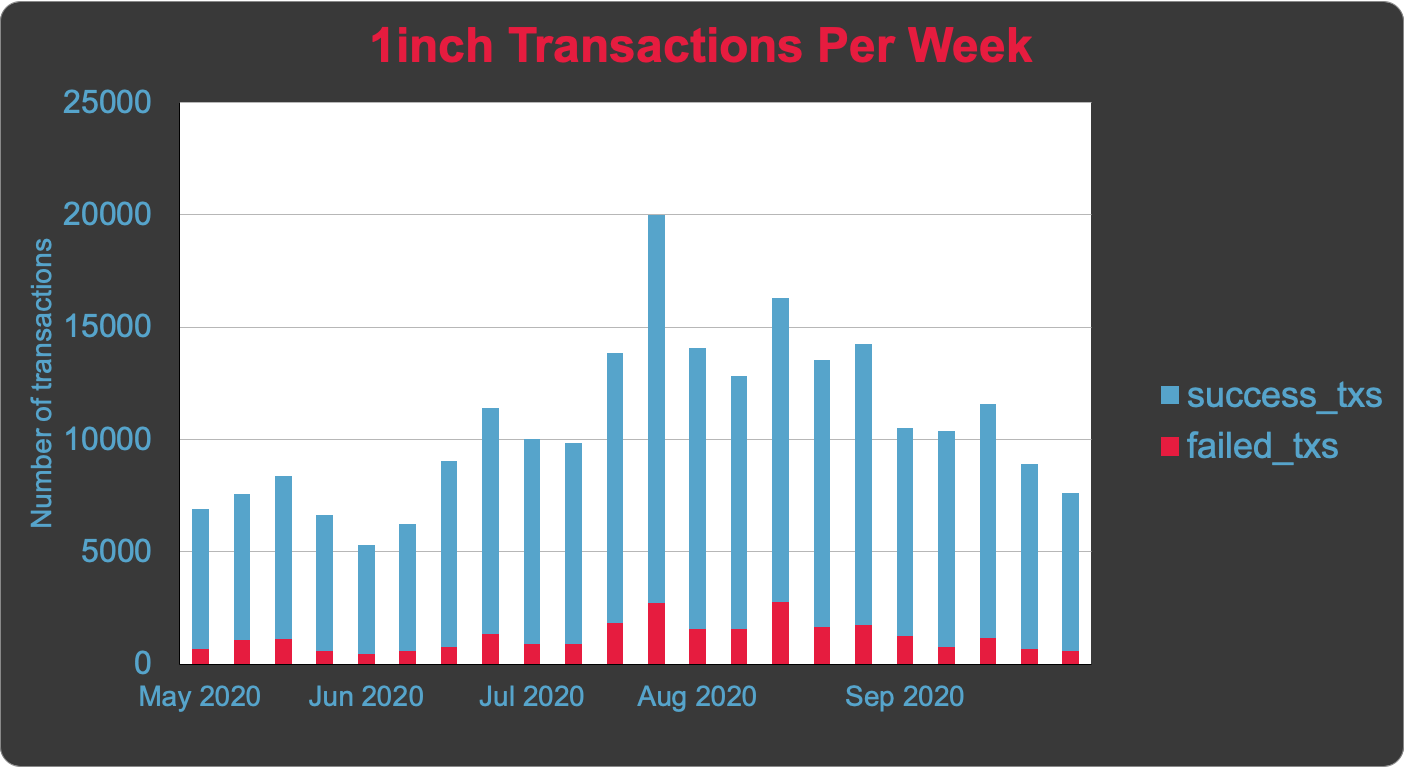

1inch’s main focus is technological innovation. In a constant drive to improve user experience, we have recently achieved several major milestones. In September, the proportion of failed transactions on 1inch significantly declined from 13% -14% (in the previous month) to just 9%. We realize that failed transactions, in which users still have to pay for gas fees, are a major issue especially at times of network congestion. We will continue to work on driving down the proportion of failed transactions. Our Chi gas token, which takes advantage of Ethereum’s storage refund, helps reduce transaction costs. Since the May 2020 launch, Chi has saved 1inch users over $2.5 million in gas fees. (Source)

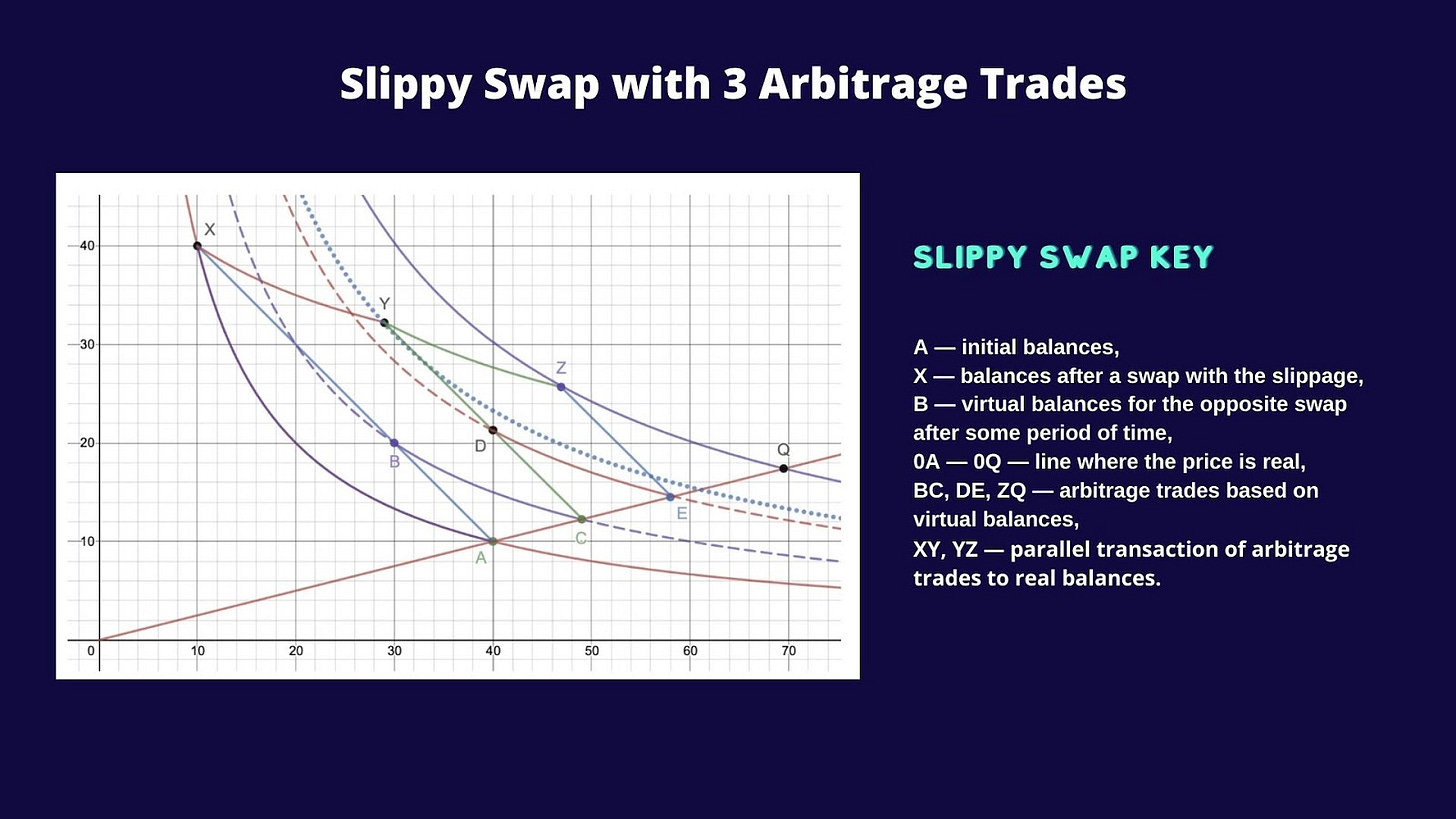

In mid-August, 1inch launched Mooniswap, an AMM that enables liquidity providers to capture profits otherwise captured by arbitrageurs. Mooniswap uses virtual balances to keep most of the revenue from price slippages in the liquidity pools. When a swap occurs, the market maker does not automatically apply the invariant algorithm or display the new prices for upcoming trades. Rather, the AMM updates exchange rates for arbitrage traders slowly--over approximately a 5-minute time period. As a result, arbitrage traders only collect a portion of the price slippage, while the rest remains in the pool to be shared amongst liquidity providers. The Slippy Swap figure below specifies how Mooniswap is able to convert more price slippage profits into Liquidity Provider earnings than traditional AMMs can. Since the August 10 launch, Mooniswap has grown to nearly $120,000,000 in total liquidity.

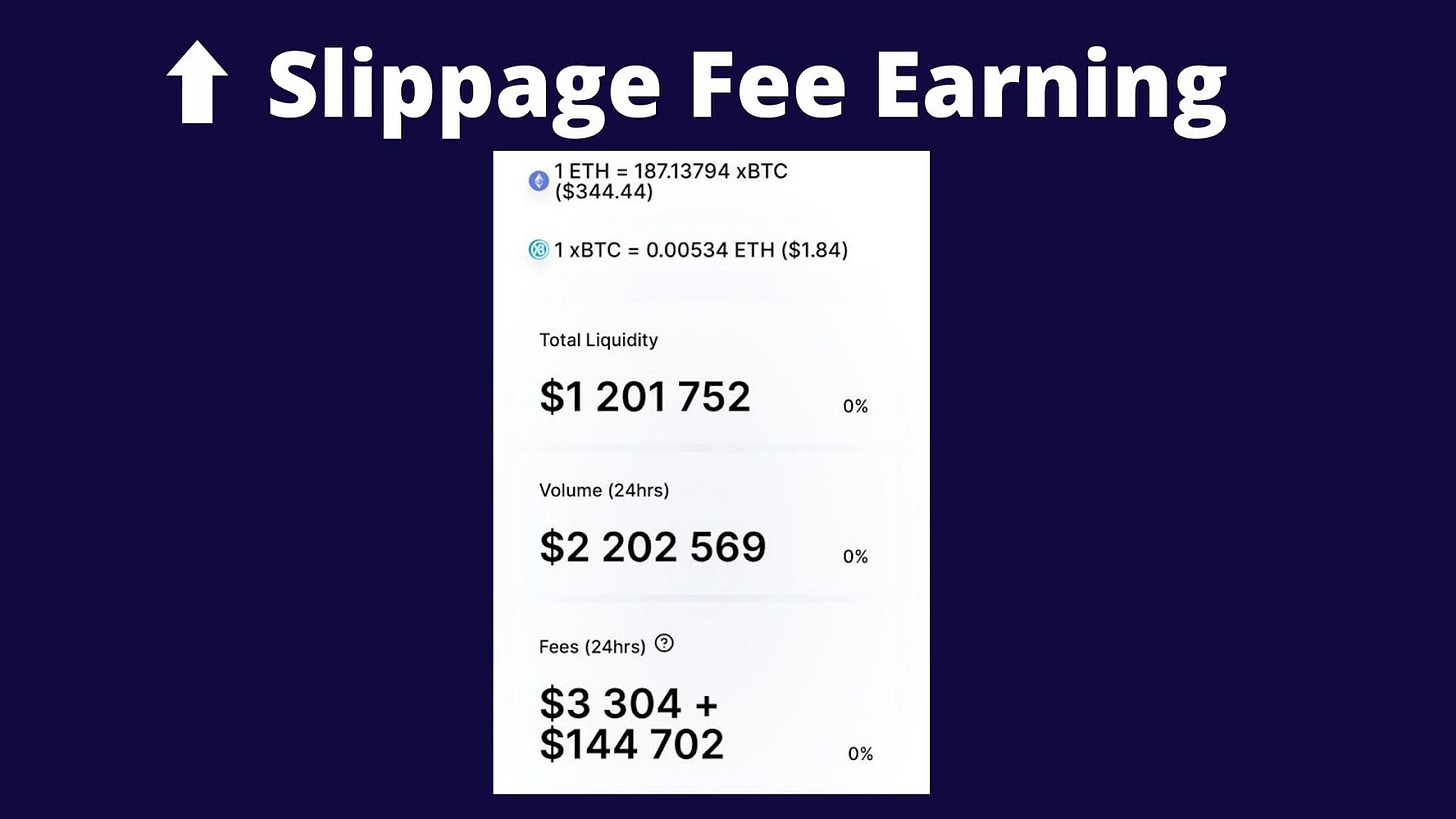

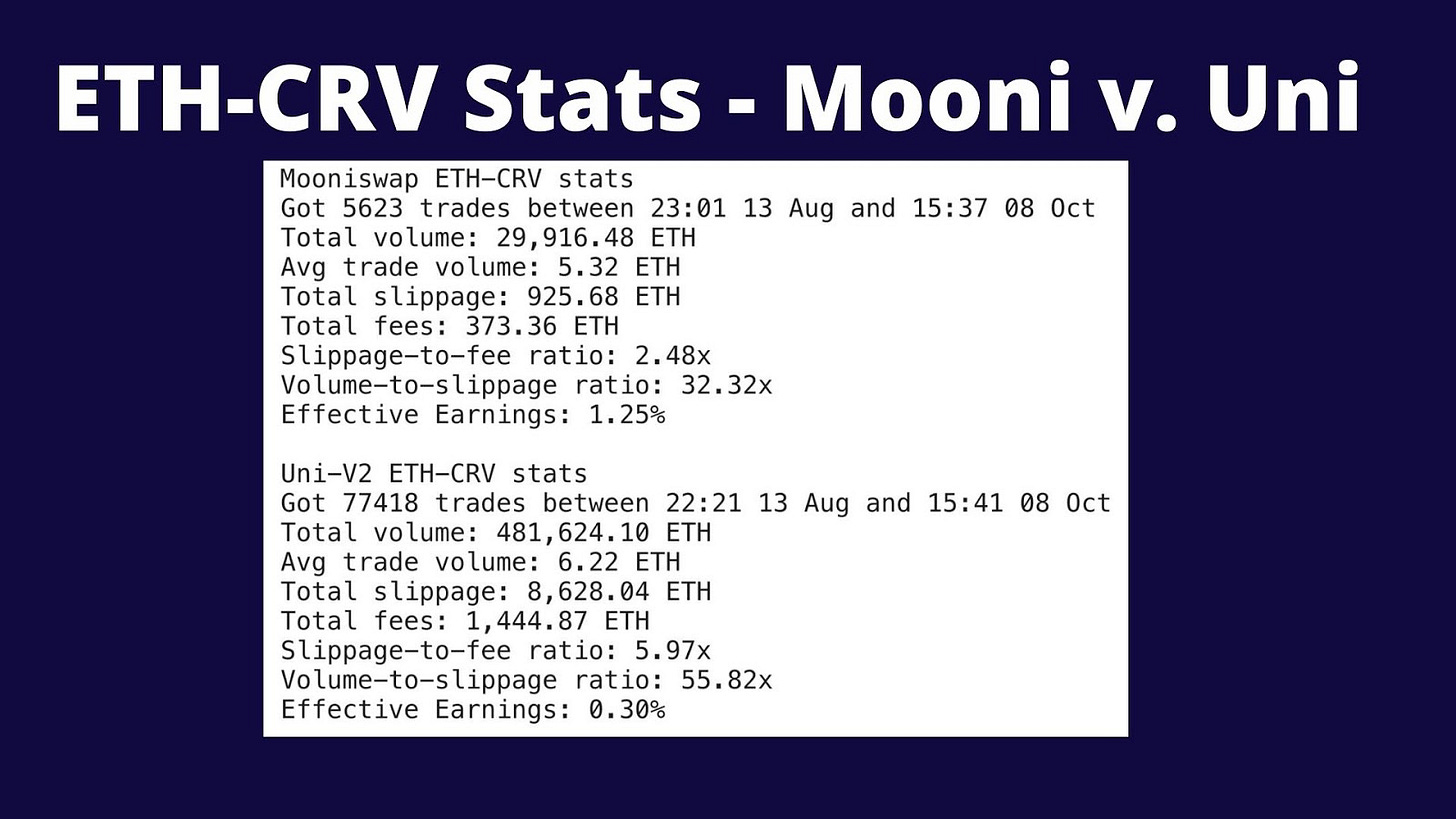

We launched Mooniswap in August with a 0.3% swap fee (i.e. swap fee on Uniswap). After two weeks of growth, we successfully lowered the swap fee--while maintaining a low slippage-to-fee ratio. Slippage-to-fee ratio refers to price slippage on a swap versus the swap fees collected; the Mooniswap swap fee could be reduced all the way to 0% in the future. Mooniswap achieves a lower slippage-to-fee ratio than Uniswap, whose ratio is sometimes 20x or more - the higher the slippage-to-swap-fee ratio the less value LP’s capture, given all of the slippage profits go to arbitrageurs. The Mooniswap protocol continues to test flexible swap fees in a bid to find an equilibrium rate for liquidity providers who collect both swap fees plus price slippage earnings. Currently, Mooniswap utilizes a 0.15% swap fee, while the overall APR for Liquidity Providers is significantly increased by earnings from price slippages. The figure (see second image) below demonstrates Mooniswap’s lower slippage-to-fee ratio on the ETH-CRV pair. Moreover, Mooniswap’s virtual balance mechanism enables the AMM to provide an efficient solution for price discovery and to position the platform for IEO offerings. The first image below demonstrates an example of a high slippage fee earning on a volatile asset during the xbtc IEO on Mooniswap.

③ Kyber Network

Contributor: Deniz Omer, Head of Ecosystem Growth at Kyber Network

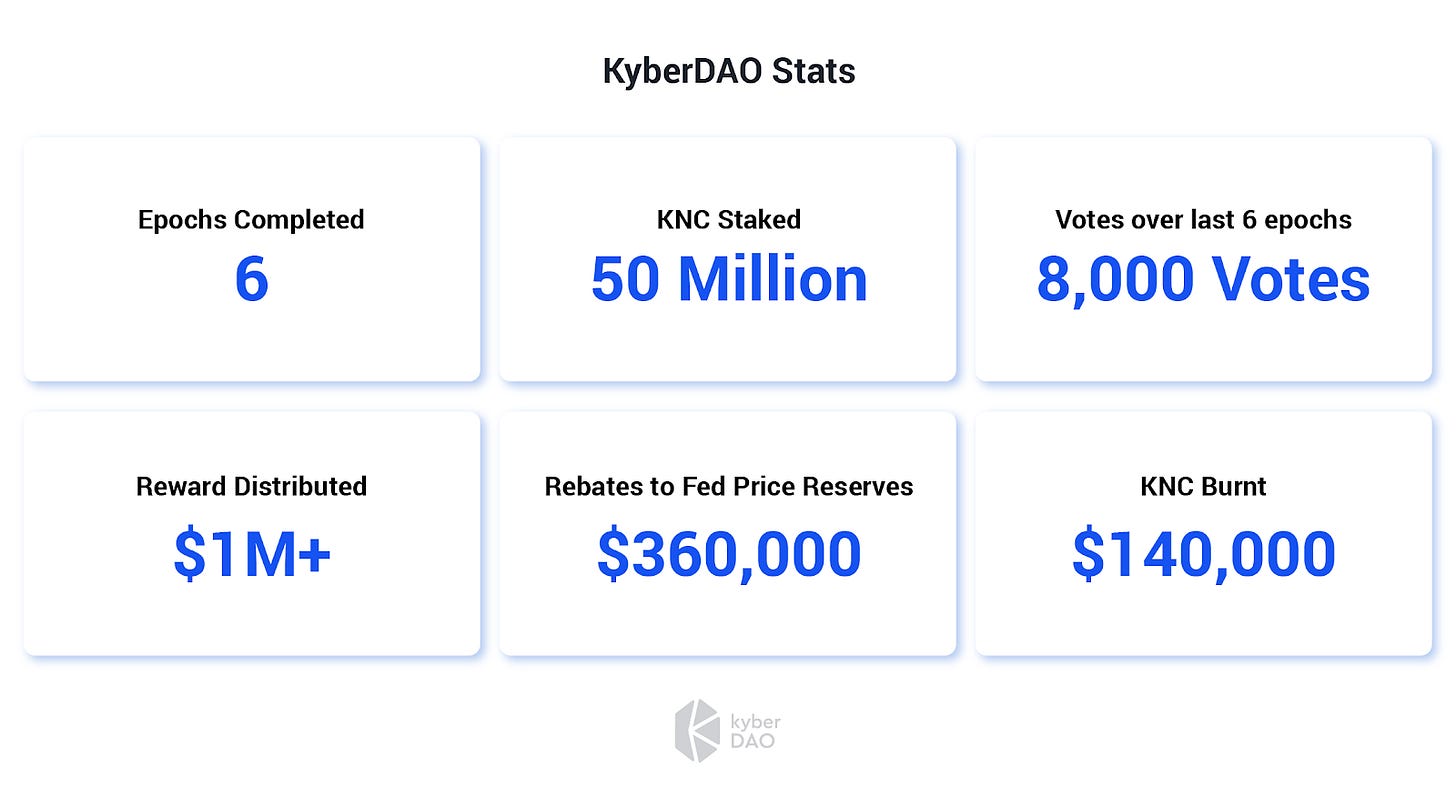

6 epochs and 3 months into the KyberDAO’s launch, participation in governance remains high with over 8,000 votes cast and more than $1M distributed. The latest network parameters as decided by the DAO are to distribute 67% of the Kyber Network fees as rewards to KNC voters, 26% as rebates to Fed Price Reserves, and burn 6% in the form of KNC. There is also currently an active governance vote on KIP-3 to reduce the network fees from 0.2% to 0.1%

Fed Price Reserves (FPR) continue to dominate Kyber Network volumes as their flexible, hands-on and dynamic approach to on-chain market-making makes them more competitive than static market makers who use predetermined pricing curves. On the other hand, the new Sushiswap and Curve bridges are also showing strong performance even though they were deployed in the last quarter of the month.

Stablecoins make up two thirds of all Kyber trading which is not surprising given their very high usage within DeFi. For many investors, lending relatively stable fiat currencies at 15% and above APRs in dapps - like Aave and Fulcrum - is far more attractive than the current 0.1% they receive from conventional bank savings accounts.

For the second month 1inch.exchange was the largest consumer of Kyber Network’s liquidity with $47M in monthly volume while the top 10 integrations continue to be a wide range of Ethereum ecosystem dapps including wallets, DeFi dapps and liquidity aggregators.