Click here to join the Our Network community on Telegram.

This is issue #32 of Our Network, the on-chain analytics newsletter that reaches more than 3000 crypto investors every week.

Top DeFi Twitter Accounts

Before we jump into this week’s coverage, announcing the winners of our recent Twitter poll:

This week our contributors cover DeFi projects: yEarn, Terra, and MakerDAO.

① yEarn

Contributor: Alex Svanevik, co-founder of Nansen and D5

YFI might be the single best example of how useful on-chain data can be for analyzing tokens. With no pre-sale, the token distribution has been 100% organic, delighting farmers worldwide. Literally the whole history of YFI is captured on-chain from farm to fork. For those new to it, YFI is the governance token for DeFi yield aggregator yearn.finance, which aims to maximize yields for depositors across multiple DeFi protocols. Holders of YFI decide the future of yearn.finance via on-chain voting. Let's take a look at three aspects of YFI using on-chain data: farming, liquidity, and hodlers.

Among the top farmers, three addresses were able to claim >1,000 tokens each from the pools that distributed YFI. At the time of writing, this translates to ~$24M in YFI tokens for these three alone. Interestingly, there's no clear pattern in which pools the top 15 farmers focused on. Among the top 15 farmers, only four stuck to a single pool, while most were farming from at least two pools.

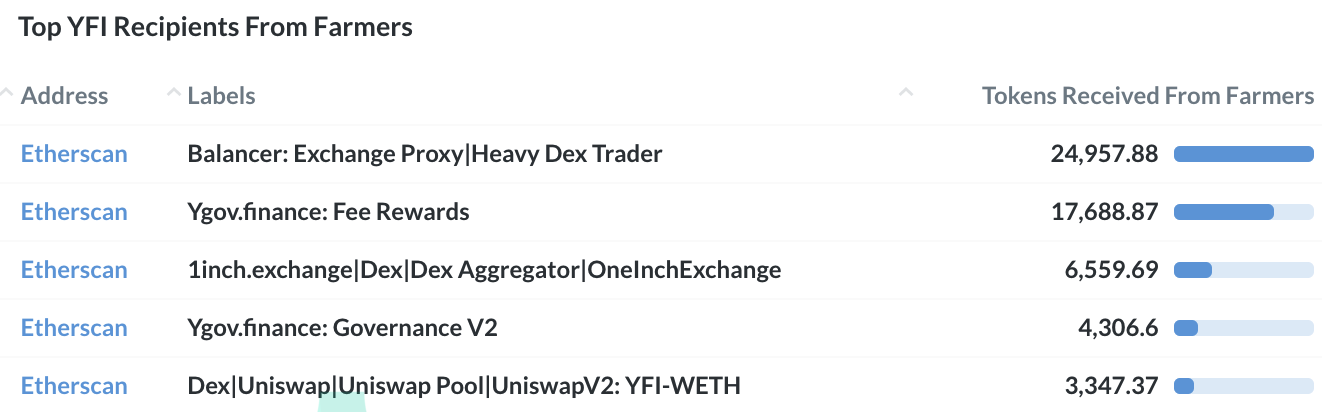

So where did these farmed coins end up? Looking at gross YFI volume sent from farmers, we see 5 top destinations:

Balancer (mostly liquidity provisioning, some selling)

Ygov.finance (Fee Rewards; staking)

1inch.exchange (mostly selling)

Ygov.finance (Governance V2; staking)

Uniswap (liquidity provisioning and/or selling)

We can drill down on liquidity by looking at tokens sitting on exchanges. Balancer was a key part of the YFI distribution (via pools 2 and 3), which explains the bump over the first ~9 days. But centralized exchanges have become more prevalent since then, with Poloniex and FTX leading the way. And Uniswap has overtaken Balancer for the deepest liquidity pools among decentralized exchanges. The relative scarcity of YFI on exchanges is likely the main driver of price action - especially since the YFI pools stopped distributing tokens.

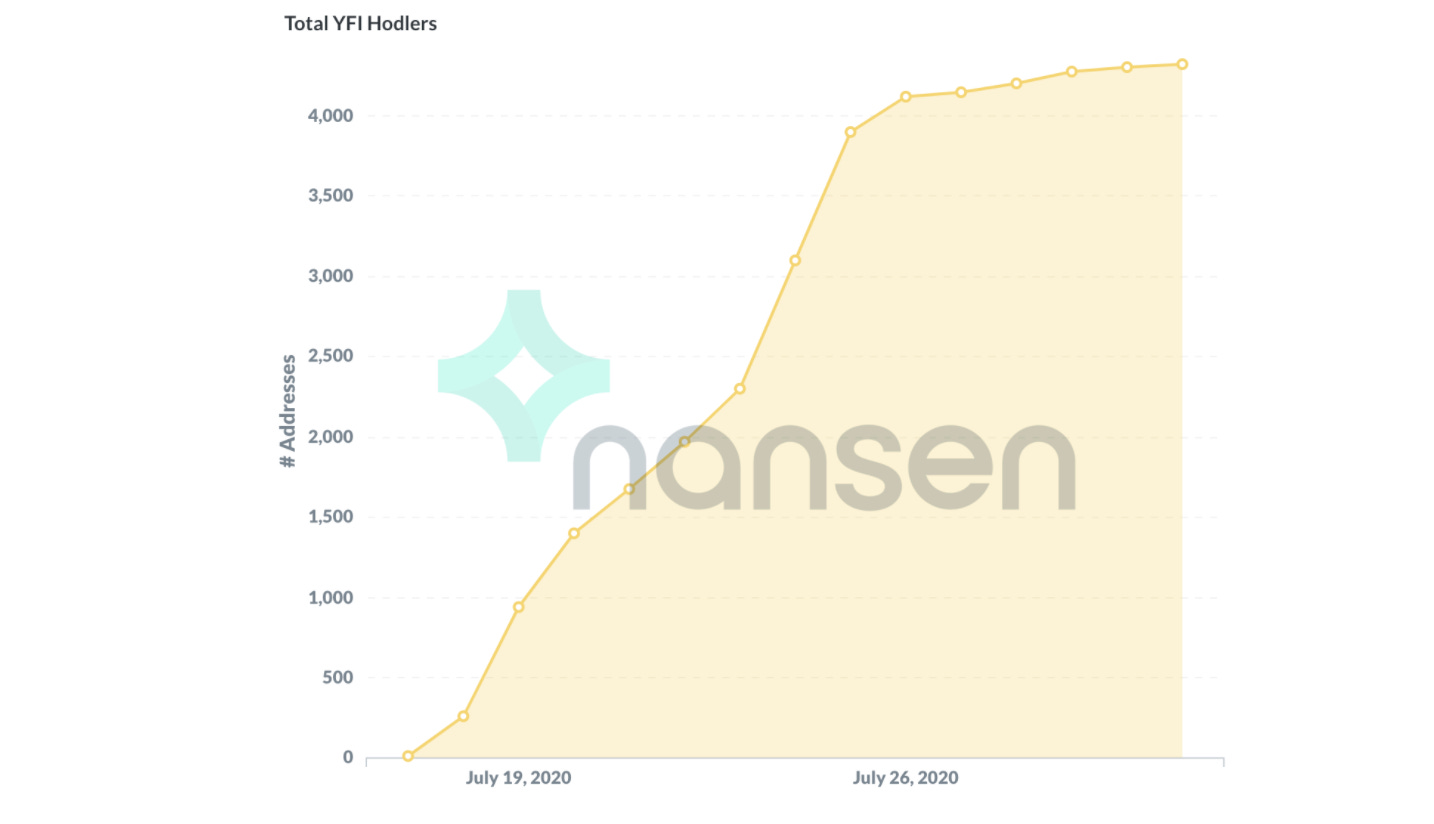

So what about the wallets hodling YFI? The YFI pools have been effective in getting YFI into the hands of thousands of wallets. But since the YFI distribution stopped, the increase in addresses has slowed down. Instead, larger investors picking up YFI are now likely a key driver of price action. Smaller retail traders getting involved before the whales is an interesting DeFi trend which stands in stark contrast to the ICO boom of 2017.

Whales are definitely getting their fair share of the action though, with some hiding in plain sight. The #1 YFI whale is currently staking their 1,858 tokens in the Fee Rewards contract (so you won't easily spot them on Etherscan's balance rankings). It's fair to assume some whales are spreading their tokens across multiple wallets.

Finally, a new contract for staking YFI was recently launched, and as you can see, some top YFI holders have already moved their tokens into this contract:

② Terra

Contributor: Christopher Heymann, Partner at 1kx

After looking at merchant adoption data in the last edition, it is worth taking an updated look into the core metrics of the Terra protocol. The peg of KRT to Korean Won has been getting a bit under pressure over the past few months. Notably since around March this year, the variations have increased and KRT is trading more than 80% of the time below the peg. Although these variations are still very small in comparison to other algorithmic stablecoins, they seem to highlight a small outflow of KRT out of the system. Improving on- and off-ramp and exchange infrastructure, as well as lowering market-making barriers will be counteracting measures to observe over the coming months.

The total user growth of Terra has remained strong and almost 500,000 new users were onboarded over the last 3 months alone through the CHAI app. It is expected that CHAI onboards user number 2,000,000 sometime in September. Other wallet apps for different currencies are also expected to launch over the coming months and there will hopefully be some data to share about cross-currency usage the next time Terra is featured in this newsletter.

Volume growth for KRT has remained strong and Terra is on the way to pass 1 trillion KRT (~$836 million) in cumulative volume over the next 6 months. It is worth highlighting again that this is organic volume from real-world purchases made with cryptocurrency technology today. Coinbase Commerce in comparison, which facilitates E-Commerce payments via BTC, ETH, or other cryptocurrency assets, has only processed cumulatively $200 million worth in transactions in the two years since its existence (source).

Staking rewards in Terra are denominated in KRT and can, therefore, yield compounding returns when those KRT are used to purchase more LUNA which is used for staking. The percentage staking yield vs LUNA in Terra is consequently inversely proportional to the price of LUNA - the higher the LUNA price becomes, the lower the APY gets even if the absolute tax returns for the protocol are growing. The protocol automatically responds with increases in tax rates to these situations to return the APY into higher territory. The following graph illustrates this relationship.

③ MakerDAO

Contributor: Primož Kordež, Founder of BlockAnalitica

YFI & YFII yield farming is influencing the DAI peg — which we can see from the 7 different numbered moves on the below chart (descriptions below):

Pool1 (yCRV) started at 7/17 11:50 UTC. Farming capital starts to shift into yCRV. Some of the Compound DAI farmers and other DAI holders deposit DAI into yCRV, increasing DAI weight in the pool and pushing the price down.

Pool2 (DAI-YFI 98/2) starts at 7/18 9:35 UTC. Some farmers from Pool1, and new farmers withdraw and/or buy DAI from yCRV in order to start farming Pool2, decreasing DAI weight in the pool and pushing price up.

Pool3 (yCRV-YFI 98/2) starts at 7/19 15:38 UTC. Price of DAI decreases sharply after the pool is open, as some farmers enter the yCRV with DAI, increasing the weight and decreasing the price.

At this point, Pool2 (DAI-YFI) had the highest yield and new farmers started joining it. DAI was either withdrawn or bought from yCRV, pushing the price to $1.04.

Pool2 (DAI-YFI) ended on 7/26 15:38 UTC. Farmers are now exiting the DAI pool, some of them switched to Pool3 (yCRV-YFI) for the final hours of the farm, increasing DAI weight in yCRV and decreasing the price heavily.

At this point, YFI farm is concluded and farmers are moving their capital to other farms, the largest for DAI capital being Compound. This dynamic again drains the DAI from yCRV, pushing the price up.

As YFI farming pools concluded, a fork of the project called YFII emerged, mimicking YFI liquidity mining pool architecture, but with an altered issuance schedule after week1 of farming is complete. Pool2 for YFII (DAI-YFII 98/2) started on 7/27 16:00 UTC which is once again draining DAI from Curve and other liquidity based markets, causing upwards pressure on the price.

The new DAI YFII pool week 1 rewards conclude on 8/3/2020 16:00 UTC, and the Week 2 farming will continue with halved rewards, effectively halving APY. As the APY heavily depends on the price of YFII, it is hard to estimate how many farmers will exit DAI YFII after Week 1 rewards conclude, but DAI might experience downwards pressure as a result.

As shown, liquidity mining is causing large capital flows between DeFi protocols. YFI and now partially YFII, have had a strong impact on the flows of DAI between Maker, Compound, Curve, Balancer and other protocols. These flows are reflected in the Curve liquidity pools, which is currently the main market in the DAI ecosystem and also determines the price.

The chart below shows how increased DAI weight in the Y Curve pool coincides with the reduced DAI price premium observed on 26th of July when the DAI-YFI pool ended. Importantly, Coinbase and other markets are mostly following the Curve DAI price (Y and sUSDv2 pools), as arbitrageurs exploit price indifferences between CEX and Curve (note, the recent market sell candles on Coinbase DAI/USD were most likely arbitrage trades with Curve).

The table below shows yield farming activities of the largest Maker vault owners and how they utilize their borrowed DAI. The snapshot was taken at 7/30 13:15 UTC and represents more than 50% of DAI issued. The last four columns represent supply and borrow balance on Compound, account liquidity (if negative, liquidation can be triggered) and projected annual income (net interest accrued and COMP rewards based on current price).