ON #178: MEV 🦠

Coverage on MEV Blocker, Flashbots, and Jito.

About the editor: Spencer Noon 🕛 is an independent crypto investor and creator.

📣 OurNetwork is looking for a sponsor! DM me or shoot me an email if you’re interested in discussing further.Editor’s note 📝 :

Maximal Extractable Value (aka MEV) is one of the most important—and misunderstood—aspects of blockchains like Ethereum.

For those unfamiliar with the subject, here’s a great tldr from Binance Academy:

Maximal Extractable Value (MEV)…refers to a strategy to include, omit, or reorder transactions when making a new block. The goal of MEV is to make as much additional profit as possible. Block producers are best placed to do this as they have the ability to select and order transactions.

However, other network participants (known as searchers) can also pay fees to place transactions should they see a MEV opportunity, such as arbitrage, front-running, or liquidation. MEV is most often found in smart contract-enabled networks where blockchain transactions include more complex information.

Click here to read the whole explainer.

The power of searchers was on full display on Sunday when Curve was exploited for ~$70m, producing some of the largest MEV rewards in Ethereum history:

Still confused? Don’t worry—we’ve got you covered. Check out this week’s analysis and the subject will definitely start to crystallize more for you.

EXCLUSIVE ONCHAIN COVERAGE:

MEV 🦠

① MEV Blocker ⛱️

👥 Alex Vinas | Website | Dashboard

📈 MEV Blocker crosses 4 million transactions, protecting $13.4B to date

Released at the end of April, MEV Blocker is a personal RPC endpoint that protects users from frontrunning and sandwich attacks for a wide variety of Ethereum transactions. Since its launch, MEV Blocker has accumulated more than 209K users and processed over 4.7M transactions – protecting around $13.4B in trading volume and returning 311 ETH to its users.

In Q2 of this year, 1 out of every 10 smart contract interactions on Ethereum were sent privately through RPC endpoints, which is a more than a 2x increase from the previous quarter. 45% of these private transactions between May and June were sent through MEV Blocker.

MEV Blocker specializes in protecting users from harmful MEV. Users can choose an endpoint based on their needs: /fast for speed (~90% usage), /noreverts for protection against reverted transactions (~7% usage), and /fullprivacy for max frontrunning protection (~3% usage).

💦🔬 Tx-Level Alpha: In this transaction, a user swapped 3.25 ETH for 516.25 GST, creating an arbitrage opportunity between the GST-USDC pools on Uniswap v2 and Uniswap v3. As the transaction was submitted via MEV Blocker, a searcher was then able to bid $5,396 (~96% of the value of the transaction) for the opportunity to earn $5,613—which they did with a backrun bundle. In the end, the user that originally submitted the transaction got 2.55 ETH more than they would have otherwise, thanks to the rebate they received from MEV Blocker (additionally there was a 0.29 ETH fee for the validator).

② Flashbots ⚡️🤖️

👥 Danning Sui | Website | Dashboard

📈 Validator MEV Revenue ATH: 6006 ETH in Single Day

MEV-Boost is an open source software developed by Flashbots. It is as an implementation of Proposer-builder Separation proposal for Ethereum Proof-of-Stake. MEV-Boost’s adoption among validators is ~93.3% in the past 14 days—highest level of adoption since the Merge. Recent incident on Curve pools created huge MEV opportunities and Flashbots saw 6006 ETH paid out in 1 day on July 30th to validators as MEV revenue aside from gas fees. This is an all time high of daily MEV revenue in Flashbots’ history.

Wondering how MEV-Boost works? Check out this overview from Flashbots for more info.In recent months, builder market structure has diversified with new players entering the game who quickly became competitive—including Titan builder (started in March, currently ~13% share), and f1b builder (started in May, now ~5%). Flashbots’ slot share is ~14%.

Zooming in, new entrants are eating up market shares mostly from neutral builders (builder0x69, Flashbots); while searcher-builders are unaffected and still leading the market. Ranked by builder probability, beaver and rsync still make the most profit ~200 ETH per 7d stats.

🔬 Tx-Level Alpha: Following cascading events of the recent Curve exploit, MEV paid out to validators in 1 single block has hit all time high across a few different relays, as MEV bots were trying to clear out the price difference arbitrage on de-pegged assets across Curve pools. For example, in this transaction, one MEV bot gave out 570.22 ETH payment to the validator to be included with priority for a trade across the Alchemix ETH and Frax ETH pools.

③ Jito 🥩

👥 Lucas Bruder | Website | Dashboard

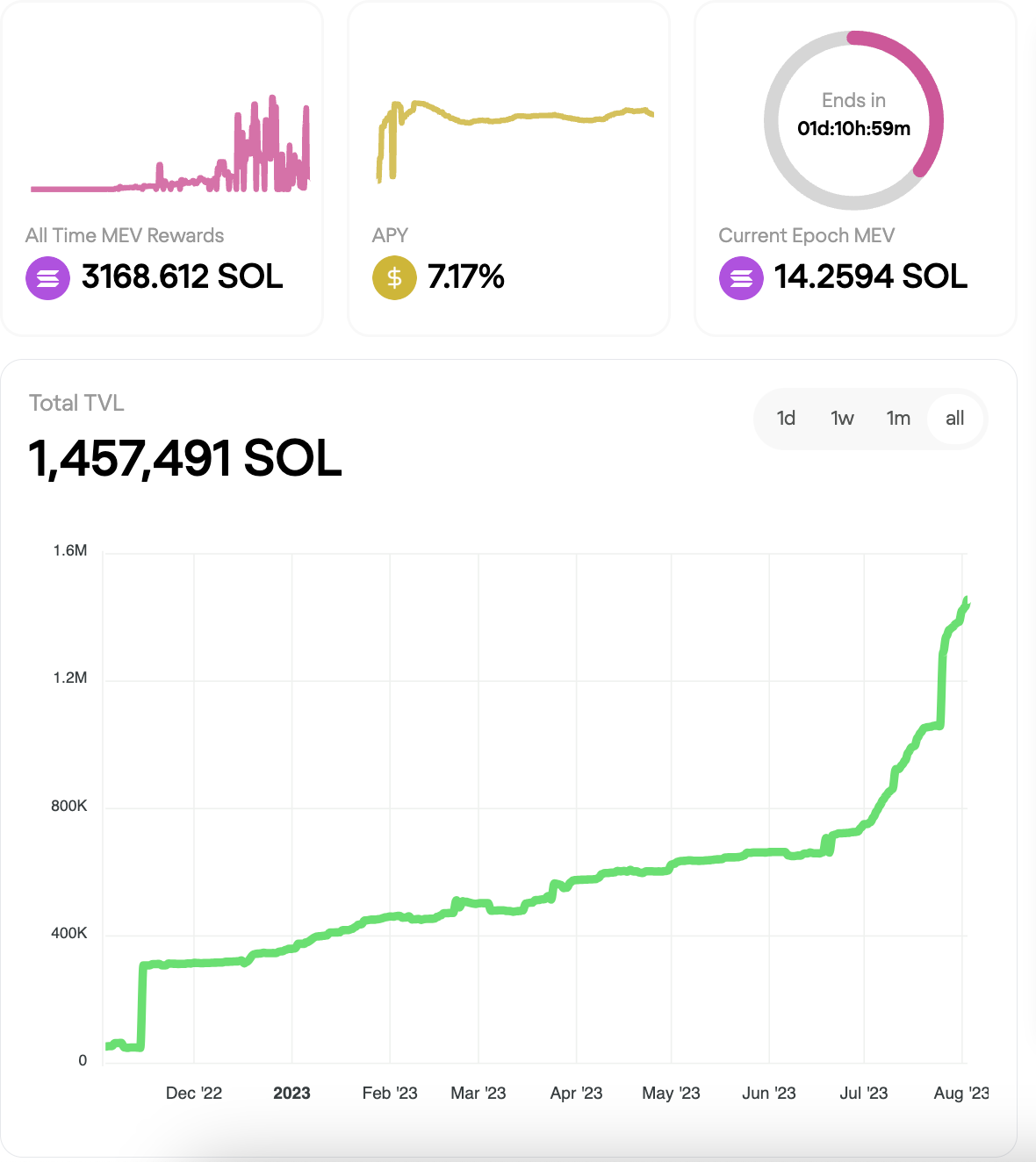

📈 JitoSOL TVL grew +140% in July, crossing 33M USD

JitoSOL is Solana’s first liquid staking token to include rewards from revenue associated with MEV extraction. Users can swap their SOL for JitoSOL to maintain liquidity and participate in DeFi, while earning MEV-boosted yield from staking. JitoSOL Yield = Staking Rewards + MEV Rewards. With Jito’s validator set running MEV-enabled clients, the pool has seen massive growth since launch, becoming the third largest SOL LST with $33m in TVL.

Currently, 97% of SOL tokens are natively staked. A maturation of Solana’s DeFi ecosystem represents potential for the expansion of liquid staking pools due to increased MEV and yield opportunities.

Revenue from arbitrage MEV is ~$263k over the last 30 days on SOL compared to ETH’s $10M. The median arbitrage profit on Jito is $0.001, while the average arbitrage profit is $0.141.

💦🔬 Tx-Level Alpha: Jito’s Solana validator client enables deterministic and atomic MEV capture, guaranteeing that a transactions in the bundle execute only if all of the transactions in the bundle execute at once. Previously this MEV was captured via spam, which wasted over 50% of Solana blockspace. Here is an example transaction where a searcher backruns a large trade atomically. The searcher harvested 72 SOL of MEV (~$1.8k). They kept 17 SOL as profit and tipped 55 SOL to the validator and stakers as a reward for transaction inclusion.