ON #163: NFT Lending

Coverage on JPEG'd, BendDAO and more.

About the editor: Spencer Noon is the co-founder of Variant Fund. If you fit one of these personas, reply to this email and say hi 👋

✍️ 🕛: NFT Lending’s breakthrough moment?

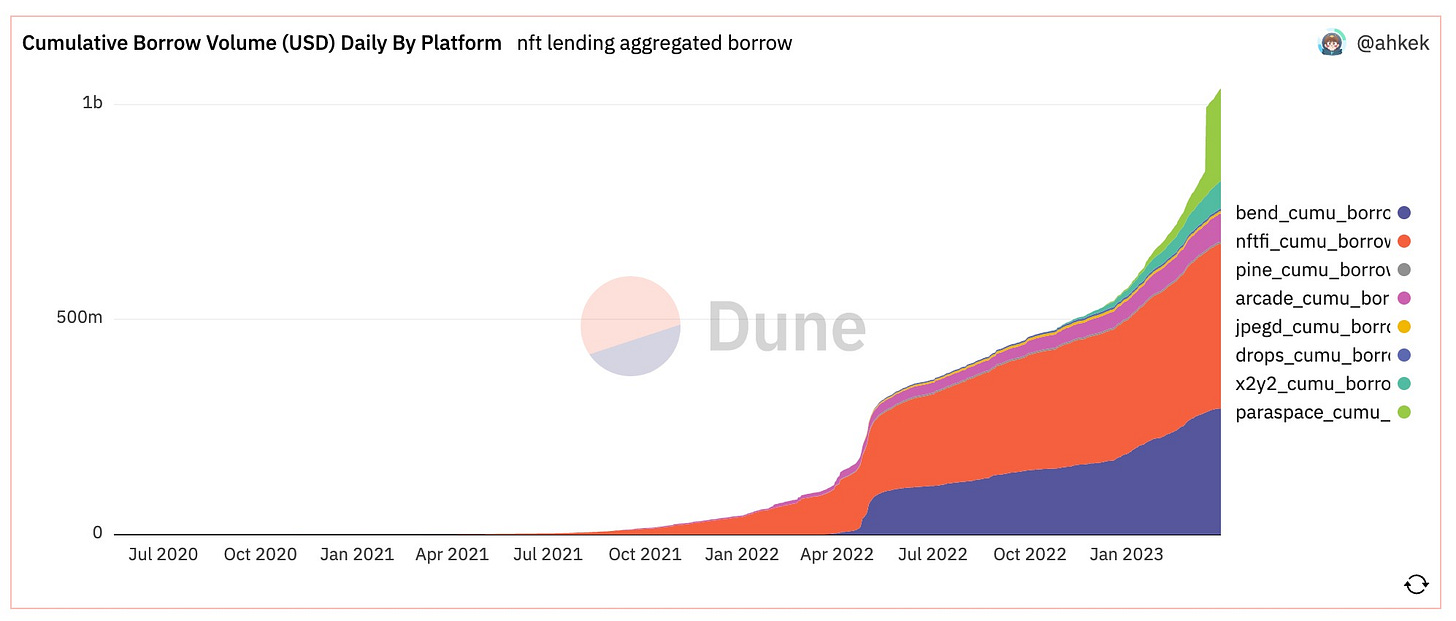

This question is fresh on my mind as last week NFT lending protocols surpassed $1 billion in cumulative borrow volume, a major milestone.

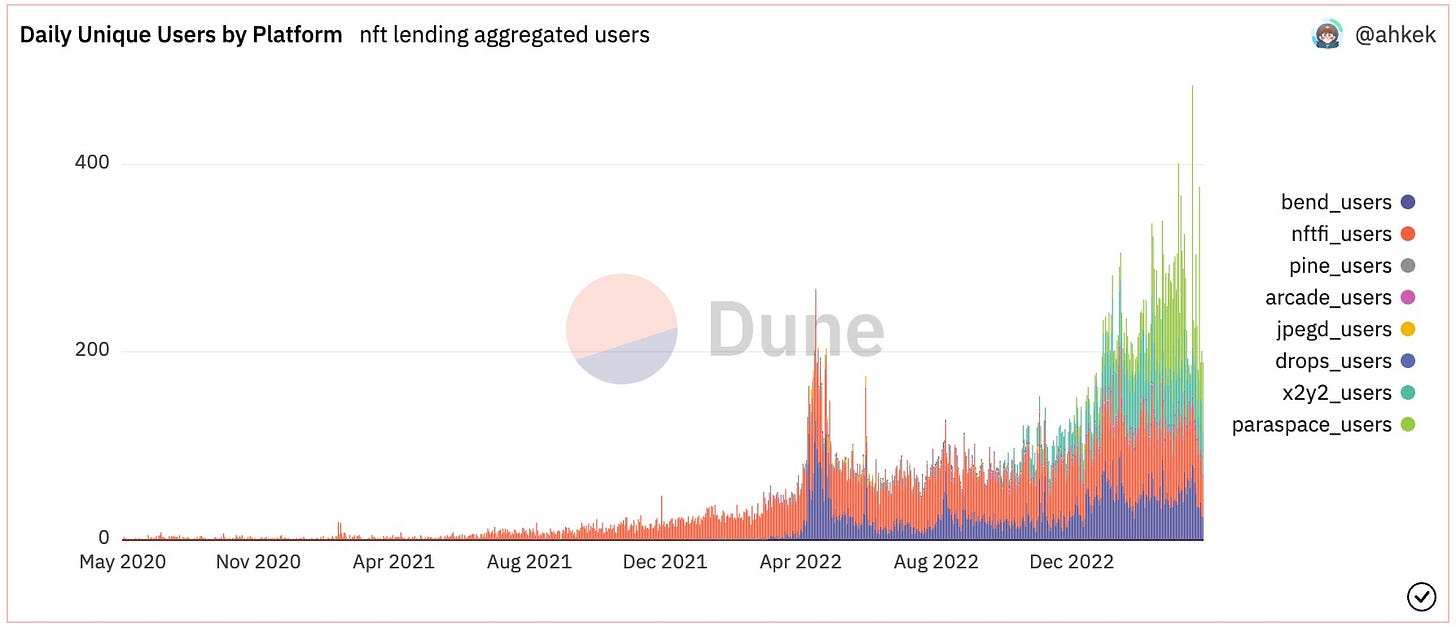

It’s still early but user growth also looks good: protocols in the category have now crossed 50k total users and at a rate that is accelerating. However, there are just 7,073 unique users overall when addresses are de-duped across protocols.

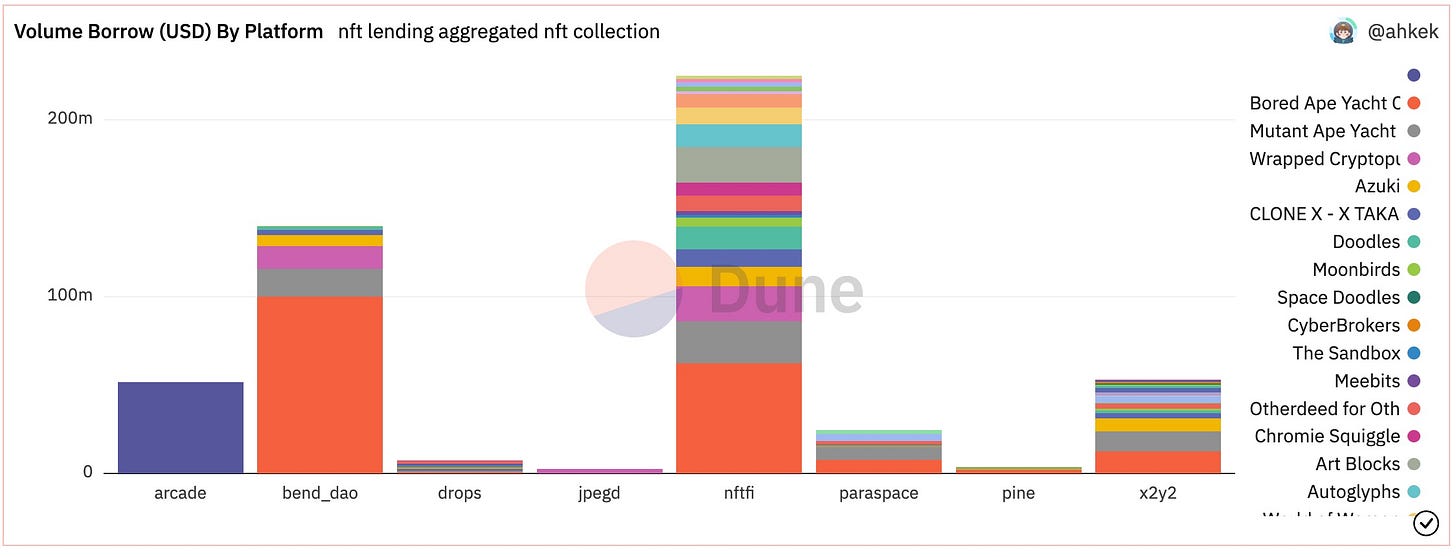

Finally, a bird’s-eye view of the category’s top protocols shows that while NFTfi and BendDAO are currently leading the pack in terms of cumulative borrow volume, a runaway leader has still not yet emerged.

One indicator I’m watching out for is when a single project has total borrow volumes that account for at least half of the cumulative borrow volumes across the entire category. While ambitious I think this could be achievable over the next year given the strong liquidity network effects of lending protocols.

Now let’s dive into this week’s coverage on NFT lending!

—Spencer 🕛

h/t Impossible Finance, whose awesome NFT lending dashboard powered the above insights

① BendDAO

👥 DAO Member

📈 1,400+ ETH & 54K+ ApeCoin in protocol income

🔗 Website | Discord | Dashboard

BendDAO is a P2Pool based NFT lending protocol that was launched in March 2022. Despite volatile NFT market conditions over the past year, the protocol's revenue continues to grow. A total of 1,254.58 ETH was generated by NFT-backed loans, and 150.12 ETH was generated by NFT trading fees and Down Payment fees. As community-owned DAO, it has earned 1,329.64 ETH (over $2.38M) in protocol revenue by locking BEND to obtain veBEND

BendDAO TVL including NFT Lending and Ape Staking reached an ATH of $279.1M this February. The P2P pairing service for Ape Staking contributed a total of 54,726 ApeCoin to the DAO Treasury. Currently, 1,094 Yuga NFTs and 5.58M ApeCoin are staking through BendDAO.

As of March 30th, there have been a total of 207 NFTs liquidated via 24H on-chain auction, and no bad debts since the launch. When an NFT goes into default, BendDAO takes the NFT into auction and sets the price of the NFT equal to the remaining debt caused by the defaulted loan.

② Arcade

👥 Gabe Frank

📈 $70M+ NFT loan volume, $9.75M lender interest earned

🔗 Website | Discord | Jobs | Dashboard

Arcade, an NFT lending and borrowing protocol, has grown since launching its V2 protocol in August 2022. Facilitating over $72M in loan volume and almost $24M in TVL, Arcade V2 boasts a loan count upwards of 1,550 with 7,350 NFTs used as collateral. With consistent month-over-month the team continues to ship new features for its growing network of lenders and borrowers.

Arcade's lender base specializes in high-value NFTs, as evidenced by a 45K average loan size and a default rate of just 5.73%. Additionally, due to the higher value of the collateral, borrowers can expect lower APRs, with an average of 15%.

Arcade's features include rollovers, making it easy to extend loan terms, and contributes $32M to Arcade’s total loan volume. Smart Vaults allow users to bundle multiple NFTs (88 in one so far) in a single loan while also supporting delegation to keep the utility of the users asset when on loan.

③ JPEG'd

👥 Derrick Nguyen

📈 450% growth in active loans since October

🔗 Website | Discord | Dashboard

JPEG’d is a decentralized lending protocol that allows users to obtain loans using NFTs as collateral. Loans can be in pETH (the Ether synthetic of JPEG’d) or PUSd (the stable synthetic of JPEG’d) and have a max LTV of 35%, that can be boosted up to 70%. The protocol uses a Chainlink oracle to monitor floor prices for supported NFT collections, such as Cryptopunks, BAYC, Azuki, Otherdeed, and more. Since October, the TVL has grown by 160% and hit an all-time-high of ~21k ETH.

JPEG’d offers liquidation insurance and locking mechanisms to boost user positions, such as +25% LTV through locked JPEG tokens, +10% LTV and credit limit by staking JPEG’d Cig Cards, and higher credit limits for rarer NFTs. So far, 734 positions have been boosted and 25% have been insured.

Despite recent volatility, active loans on JPEG'd have surged from ~110 to 608, marking a 450% increase since October. This trend suggests a continuing demand for NFT-backed loans and indicates that existing borrowers on JPEG'd are interested in the yield opportunities via pETH and PUSd.

④ Pine Protocol

👥 Jason

📈 Pine protocol crosses $4.8M total borrow volume

🔗 Website | Discord | Jobs | Dashboard

Pine protocol is a peer-to-peer loan marketplace that facilitates connections between NFT asset owners and liquidity providers. NFT asset owners can obtain ETH liquidity by depositing their NFTs into the escrow pool and borrowing ETH. The Pine protocol has been operational since the end of 2021 and has recorded a total borrow volume exceeding $4.8M, with a total of over 1.3k borrows to date.

Pine protocol has 230 unique power users who contribute an average of $20K each, totaling over $4.8M in borrow volume. Retained power users generate most of Pine's daily borrow volume.

The Bored Ape Yacht Club is responsible for contributing over 46% of the total time borrow volume of 4.8M, which equates to approximately 2.4M in total. Following closely behind is the Azuki and MAYC NFT collections, which are the second and third most popular collections on Pine.

⑤ DeFragDAO

👥 Igor Yuzo

📈 Defrag's L2 NFT lending grows 50% MoM

🔗 Website | Discord | Jobs | Dashboard

Defrag's cumulative borrowed amount has grown 280% since January 1st. Defrag is the first NFT lending protocol on Arbitrum. It has captured the rising popularity of NFTs such as Smol Brains. While most L1 NFT-Fi projects focused on high priced collections such as BAYC, Defrag attracts longer tail projects.

Collecting approximately $22,000 in fees since January 1st. Defrag has created an APR pricing model which uses the Black Scholes Model. Defrag believes this model does a better a job at pricing risk when it comes to NFTs, and fairly compensating LPs.

To keep up with demand, Defrag recently launched their version of LPs, called ULPs - Underwriting Liquidity Pools. Anyone is now able to deposit USDC to start earning proportional share of fees generated from interest paid by the borrowers.