ON #162: Derivatives

Coverage on Synthetix, Perennial, and more.

About the editor: Spencer Noon is the co-founder of Variant Fund. If you fit one of these personas, reply to this email and say hi 👋

Announcement: Today, Variant launched the Founder Fellowship. 20 emerging crypto founders will be selected to build and learn alongside Variant’s portfolio founders. Learn more and apply HERE ✅

On-Chain Coverage: Derivatives

① Synthetix

👥 Matthew Losquadro

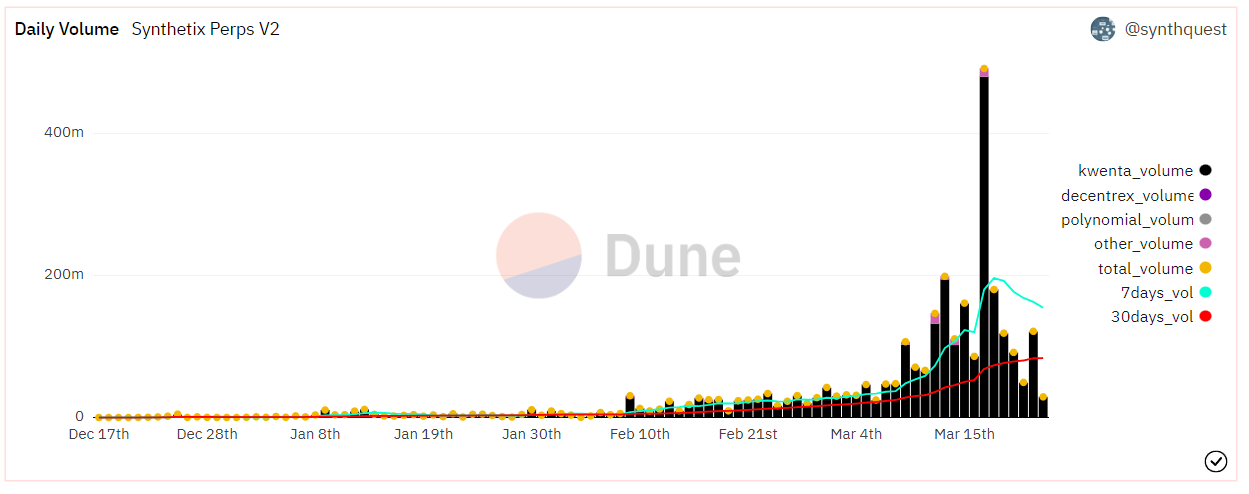

📈 Synthetix Perps surpass $490M in daily trading volume

🔗 Website | Discord | Jobs | Dashboard

Synthetix is a decentralized liquidity layer that powers an array of on-chain financial instruments, allowing integrators to tap into its liquidity and develop new financial derivatives. Synthetix' deep liquidity and low fees have sparked an expanding list of integrators such as Kwenta, 1inch, Curve, Lyra, Polynomial, and Decentrex. Launched in late December 2022, Synthetix Perps has recently surpassed $490M in daily trading volume, with protocol fees and trading volume reaching all-time highs.

Synthetix Perps has generated over $2.9B in volume and $3M+ in exchange fees. Thanks to lower fees (5-10bps), off-chain oracles, and risk management tools for stakers, the release has on-boarded 2,500 traders and 60+ unique traders per day in just four months.

The 7-day daily average for Synthetix Perps has increased significantly, from $22M per day on February 22nd to $170M on March 21st. This growth indicates continued interest in fully decentralized and non-custodial on-chain perps, and demonstrates the potential of Synthetix Perps.

② Perennial

👥 Jacob Phillips

📈 Perennial grows to $10M+ in liquidity

🔗 Website | Discord | Jobs | Dashboard

Perennial is a no-price-impact derivatives protocol designed to be a modular DeFi primitive. Perennial currently has 0% trading fees and funding rates that are 2-10x less than other protocols. Perennial’s funding rates, even at periods of high pool utilization, have floated between 4-10% APR. This compares to other protocols designed similarly that consistently see funding rates between 20-40% APR.

With no external incentives, Perennial has grown to over $10M in notional liquidity across Arbitrum and L1. At the launch of Arbitrum, Perennial introduced its first vault (similar to GLP). Vault capacity has been raised on 3 occasions, and each time, the vault is filled within just a few days.

In the past month, Perennial has seen progress in surpassing its previous open interest and volume all-time highs. Perennial’s latest 7-day volume total was $24.5M, a 540% increase from its first full week on Arbitrum. March 23rd was Perennial’s biggest day yet, with over $7M in 24H volume.

③ GMX

👥 Shogun

📈 GMX crosses $113B total volume

🔗 Website | Discord | Dashboard

GMX is a perpetuals DEX on Arbitrum. The project has facilitated $113.13B in total volume, generated $173.58M in platform fees, and on-boarded over 173,733 Unique Users. GMX continuously maintains 50% of the fees market share, compared to ~36% of volume market share. The reason for the disparity is mostly the difference of how much margin volume is traded compared to the notional volume.

GMX previously controlled most volume, peaking at 89.7% relative to the other top decentralized exchanges. More recently, several formidable competitors gained traction, including Vela Exchange, Gains Network and Level Finance, leaving GMX with ~34.3% of the market.

This graph takes the delta of the open long and short positions on GMX to try to describe the state of the market. In the first state, there is a positive constant of ~$3M OI delta for 3 months - meaning sentiment is positive / bullish, which leads to a decline after June. This trend reversed from October to December, where there was a negative constant delta of ~$36M OI delta.