About the editor: Spencer Noon is Co-founder & General Partner at Variant Fund.

Email Me | Talent Form | Twitter | ON Learn | Disclosures

Note from the editor:

In case you missed it — yesterday I posted a thread about how crypto can learn and move forward from the recent events regarding FTX. While this week represents a major setback for the industry on multiple fronts, I have as much conviction as ever that crypto has the potential to build a more meritocratic internet and a safer financial system.

Network coverage:

Coverage on Gearbox, Euler, and Goldfinch.

① Gearbox

👥 Jared Hedglin

📈 Gearbox TVL passes $100m

🔗 Website | Discord | Jobs | Dashboard

Gearbox allows users to deploy leveraged positions across DeFi protocols and enable boosted APYs in a composable manner. On Gearbox, LPs supply funds to pools in order to earn interest. Borrowers create a Credit Account (CA), deposit collateral, and obtain up to 10x leverage from the LP pools directly. CA users can then deploy the levered capital on popular DeFi protocols. Since V2 launch on Oct 31, TVL and capital borrowed on Gearbox have increased more than 10x to $100m and $70m, respectively.

The increase in utilization was driven by the community with the number of users (liquidity providers & CA owners) growing 16% in 11 days to reach 1,858. Since Gearbox is currently limiting Credit Account access to whitelisted Leverage Ninjas, with the intent of limiting risk, the recent growth in CAs reflects only a fraction of the total demand to use the protocol. The protocol will fully remove the whitelist in the future, but there seems to be early PMF with borrowers.

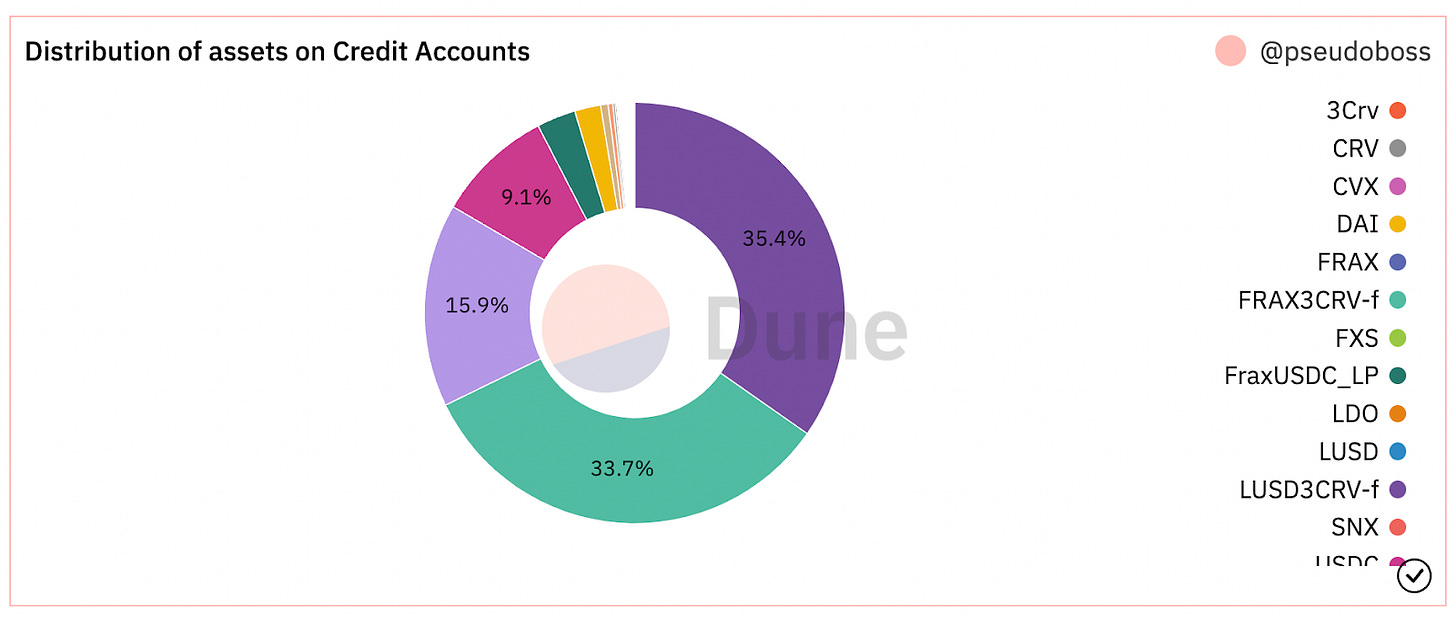

Using Gearbox, borrowers can leverage trade on Uniswap/Sushiswap, or lev. farm on Yearn, Lido, Curve, and Convex. CAs make it possible to use decentralized leverage in complex delta-neutral yield farming strategies, e.g. using USDC for collateral, borrowing more USDC, and deploying funds to Curve and Convex pools. Currently, the most popular strategies are leveraged stable farming: LUSD3CRV-f and FRAX3CRV-f account for 69% of CA assets.

② Euler Finance

👥 Nicholas Sheaf

📈 Euler, the bull case for DeFi

🔗 Website | Discord | Jobs | Dashboard

Euler is a permissionless money market that enables users to safely lend and borrow any token due to asset risk tiering. Euler's utilization has remained extremely high throughout its life. Despite the recent crisis, confidence in Euler has hit a new high. Utilization consistently hits between 80 - 100% versus Aave’s ~40% or Compound’s 44%. This leads to virtuous cycles of more lenders & borrowers.

80%+ utilization incentivizes more lenders and borrowers, making Euler's revenue versus incentives unbeaten at a deficit of $759k, versus leaders at a deficit of $1.3m despite a comparatively minuscule TVL, meaning a smaller base for fees.

This small TVL is climbing: Euler is the only money market that predated this bear market, yet has seen an overall increase in TVL. Euler took a ~50% hit from ATH, but considering market conditions this growth is impressive. Aave TVL is down to $4b from $18b, and Compound sits at $1.7b from a $12b ATH.

③ Goldfinch

👥 Melissa Nelson

📈 Goldfinch’s average USDC APY at 11%, up 114%

🔗 Website | Discord | Jobs | Dashboard

Goldfinch’s model of bringing off-chain finance to DeFi is proving stable despite a stormy six months of repeated market downturns. The 30d trailing average USDC APY on Goldfinch has risen 114% since the market crash this spring, from 5.15% in May - 11.03% today, while maintaining 0 defaults. The decentralized credit protocol remains isolated from volatility by bringing yields from off-chain businesses on-chain, via a platform for supplying USDC to proven fintechs and credit funds worldwide.

The protocol maintains this beautifully boring zero losses chart due to the portfolio strength of these Borrowers, who provide the protocol’s investors with full transparency to due diligence documentation including off-chain collateral assets, underlying investment risk metrics, and reporting.

In the last 30d USDC deposits spiked as Goldfinch launched Membership Vaults focused on participant-centric tokenomics. Continued traction despite dropping market USDC rates, as low as 0.8% on Compound, shows an early indicator of the stability bringing real-world lending on-chain can offer DeFi.