Our Network: Issue #73

Coverage on UNI, ETH, BTC, DOGE, and DOT.

This is issue #73 of the on-chain analytics newsletter that reaches more than 11k crypto investors every week 📈

About the editor: Spencer Noon is an investor at Variant, a first-check crypto VC fund.

Welcoming Jake Chervinsky to Variant

In case you missed it, yesterday we dropped the news that Jake Chervinsky is joining Variant Fund as a strategic advisor.

As General Counsel at Compound, Jake has unparalleled expertise on crypto law and policy earned by pioneering a multi-billion dollar DeFi marketplace—the first to run the progressive decentralization playbook and make their users owners.

Jake is going to unlock a ton of value for our portfolio founders, and we’re absolutely thrilled to have him as the newest member of the Variant community.

This week our contributor analysts cover Uniswap, Ethereum, Bitcoin, Dogecoin, and Polkadot.

① Uniswap

👥 Teo Leibowitz

📈 Uniswap v3 Flips v2 In Volume After Just 3 Weeks

👉 Join the Uniswap Community Discord

Just three weeks after its launch, Uniswap v3, the latest iteration of the Uniswap protocol, has officially flipped v2 on volume. Together the protocols have facilitated over $65bn in the month of May, up from $26bn in January 2021. The Uniswap protocols continue to hold 50%+ DEX volume market share. A testament to v3’s trade execution quality, the Uniswap protocols now receive 40% of weekly aggregator flows, up from 20% pre-launch. v3 activity is highly concentrated in the ETH/USDC, ETH/USDT, USDC/USDT, and ETH/WBTC markets, which collectively account for 78% of volume over the past 7 days.

The crux of the v3 value proposition is Concentrated Liquidity, and the protocol’s performance to date reflects the power of enhanced capital efficiency: v3 is already the highest volume DEX with just $1.3bn liquidity, counting 100%+ turnover rate on a daily basis. For perspective, Uniswap v2 sees just 15-20% daily liquidity turnover. v3 currently supports over 7,800 unique LPs across 1,370 unique markets — while 1% fee tier pools make up ~35% of all markets, they have attracted just 7% of cumulative volume. The median LP balance is $1,800, while the top three largest LPs have balances of $96m, $53m, and $47m respectively; this disparity reflects v3’s ability to cater to a broad range of users. As with volume, the majority of v3 liquidity is concentrated in ETH, USDC, USDT, WBTC, and DAI.

The Uniswap protocols continue to dominate Ethereum activity, with the v2 and v3 routers attracting ~25% of all network transactions. The month of May has seen over 850,000 unique addresses swap on v2 and v3, up from 327,000 in January, together accounting for over 80% of DEX monthly user market share. V3 median trade size currently stands at $3,350, more than double that of v2.

② Ethereum

👥 Ashwath Balakrishnan

📈 Ethereum Fundamentals Shrug Off Price Volatility

🧭 Explore Ethereum research and resources on ETH HUB

Ethereum’s fee ratio multiple — a metric that measures how reliant miner revenue is on block subsidies — has consistently been under 5 for all of 2021, which indicates a high, organic security budget. Bitcoin’s fee ratio multiple, while impressive, is much higher than Ethereum’s (lower is better).

456,000 ETH ($1.25bn) have been deposited in the ETH 2.0 staking contract in the last 10 days, 51% of which occurred in the last 3 days. With over $14bn staked and 80,000+ validators, ETH 2.0 is already the largest Proof of Stake network (and it isn’t even functional yet).

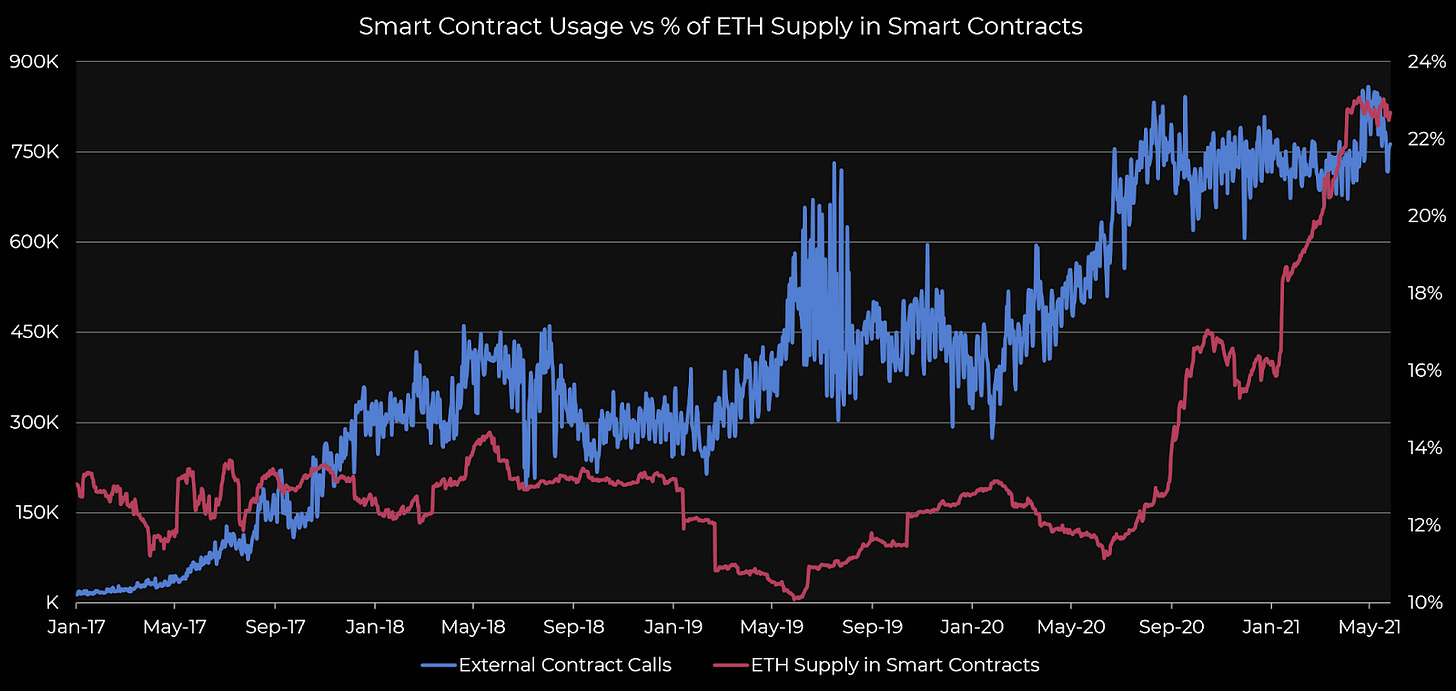

Despite the last week’s volatility and price decline, Ethereum usage remains at all-time highs. The percentage of ETH supply locked in smart contracts was unfazed by market conditions, and smart contract usage from users has remained at elevated levels seen since DeFi summer kicked off.

③ Bitcoin

👥 Nate Maddrey

📈 Bitcoin Security Still Strong Despite The Crash

🧭 Explore Bitcoin

Over the last two weeks, reports have surfaced that the Chinese government is starting a crackdown on Bitcoin miners. Bitcoin’s estimated hash rate (7-day avg.) has dropped about 20% since then, which could potentially be a sign that some Chinese miners are going offline. In this scenario, hash rate should bounce back as displaced miners start to relocate. Despite the drop, the network is still secure - even if hash rate dropped by 50% Bitcoin would still be resilient against attacks.

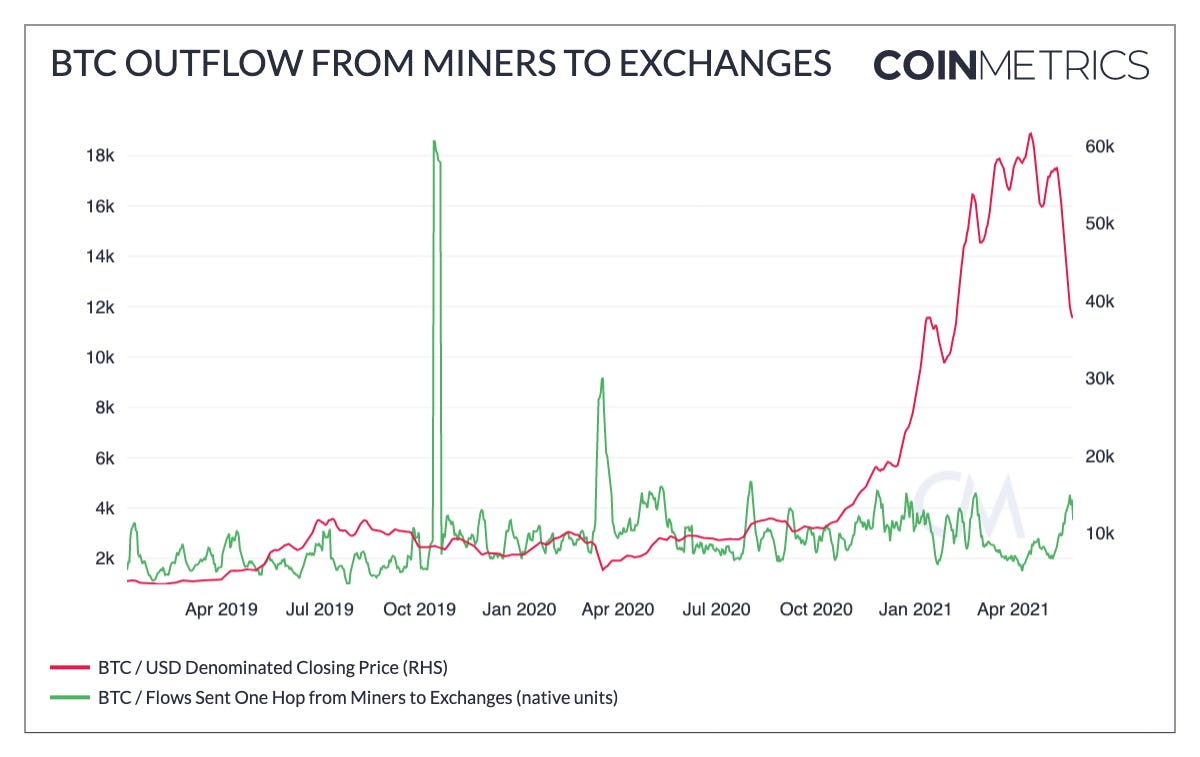

The amount of bitcoin sent from miner addresses also spiked over the last fews weeks, which could be partially caused by Chinese miners moving their coins to sell. However, it peaked on May 23rd and has been declining since then, hopefully signaling that selling is abating.

Despite the uptick in miner outflows, there has been reduction in flow from miners directly to exchanges — potentially due to miners selling OTC. However, in the past miner outflows have correlated with transfers to exchanges, which suggests something has changed with this recent outflow.

④ Dogecoin

👥 Lewis Harland

📈 Elon Spurs Dogecoin Developer Activity

👣 Follow Doge Activity On Github

Santiment indexes developer activity from Github repositories based on a wide range of event variables and is useful as a proxy measure for developer commitment to maintaining/upgrading a network’s codebase. After being largely nonexistent since 2017, developer activity has picked up significantly in 2021. Elon’s Dogecoin tweets have preceded upticks in developer activity [the following numbers correspond with the graph below]: (1) “Dogecoin Our Network” (2) “Dogecoin is the people’s crypto” (3) “Picture of Doge on The Moon” (4) Elon's GitHub call to action

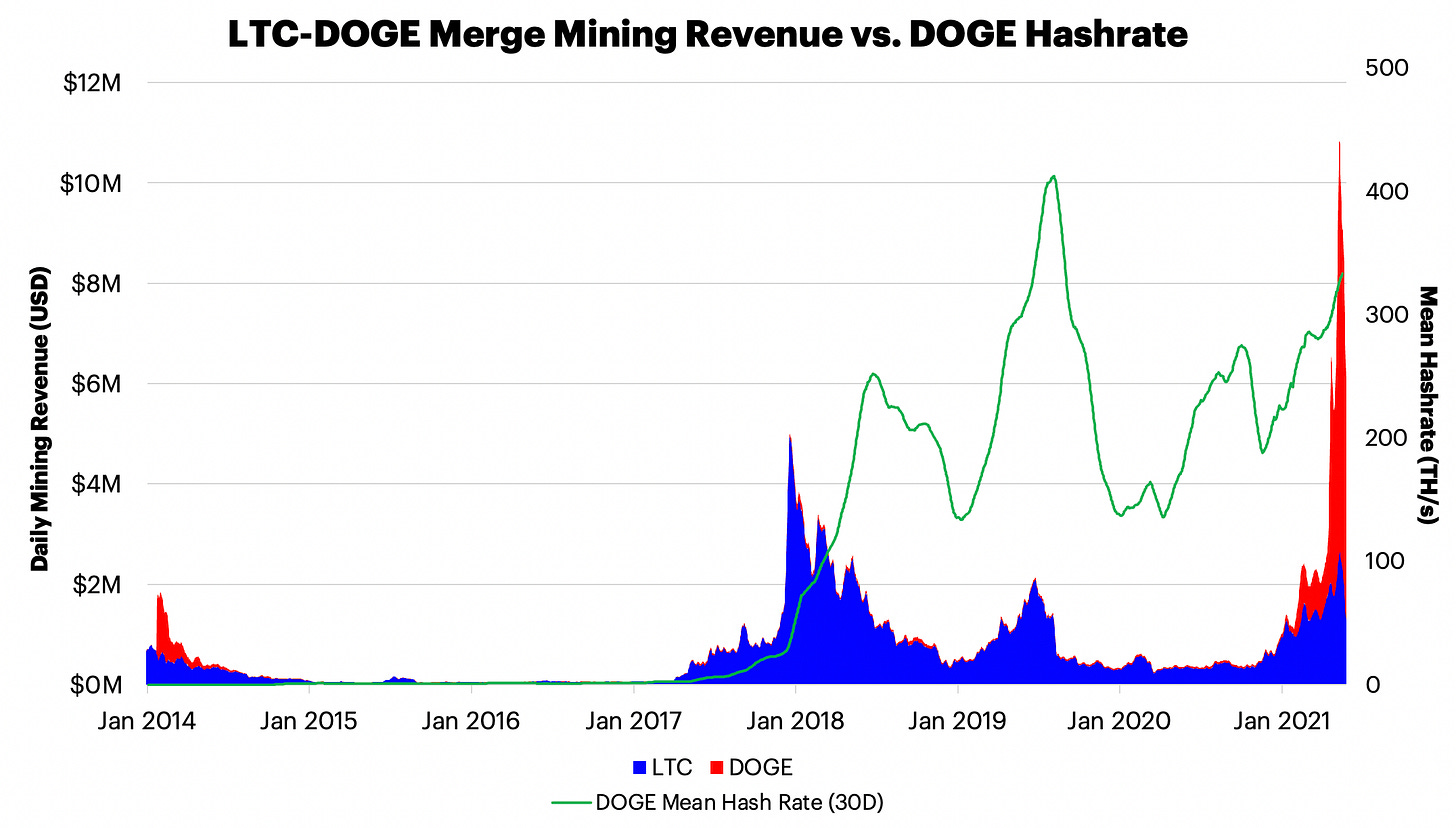

DOGE has historically made up 10% of all LTC merge mining revenue. Litecoin miners are seeing 5x increase in daily revenue (80% from DOGE income). Opportunistic LTC miners have driven up Dogecoin’s hashrate by 48% YTD (30D) with the merge-mined coin now having a higher market cap than its base coin.

As of May 26th, only 62% of Dogecoin nodes are synced within 5 blocks of the chain tip, partially driven by Dogecoin’s 1-minute block times. Lower numbers of fully synced nodes make it harder for new nodes to connect and sync to the network, highlighting certain deficiencies at the network layer.