Our Network: Issue #7

Updates on Nexus Mutual, PoolTogether, Stablecoins, Kyber, and 0x.

Our Network is a weekly newsletter where top blockchain projects and their communities share data-driven insights.

Welcome to Our Network #7! (And maybe the beginning of a new crypto bull market?)

This week our contributors provide data-driven coverage on some of the marquee projects in the decentralized finance space:

Nexus Mutual

PoolTogether

Kyber Network

Stablecoins

0x

Thanks for being a subscriber. Now let’s dive into the updates.

Network Updates

📌 Nexus Mutual

Contributor: Richard Chen, Partner at 1confirmation

$1.6M worth of smart contract insurance is currently taken out on Nexus Mutual. Active cover amount is one of the two important KPIs for Nexus (the other being capital pool size). The growth in cover amount in Dec and Feb were from large covers taken out for Flexa and ParaSwap.

Breaking down the active cover amount by smart contract system. Flexa ($589k), Compound ($314k), ParaSwap ($265k), and Uniswap ($210k) currently have the most money being insured.

The current capital pool size (insurance fund backing claims) is $2.6M or 13.1k ETH. This is the second of the two important KPIs for Nexus. Note the USD graph has been fluctuating due to the volatile price of ETH, but the capital pool which is denominated in ETH has been steadily growing.

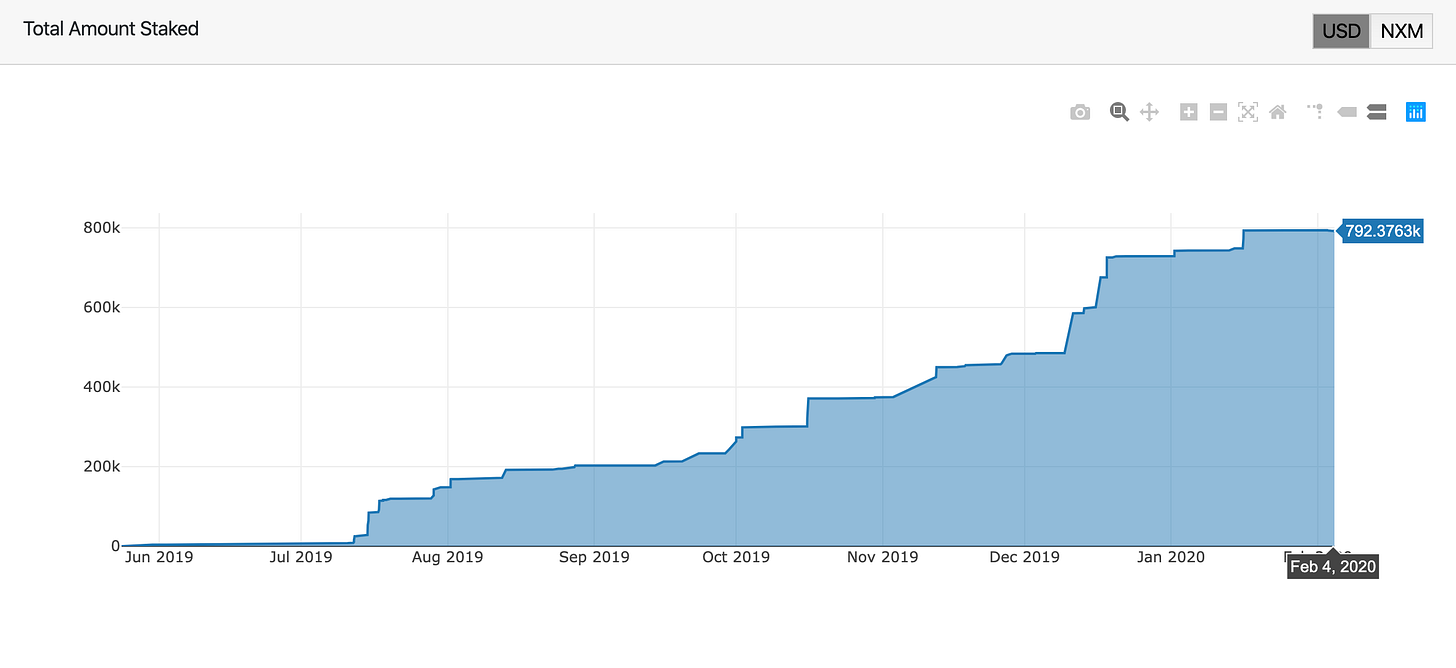

The premiums for smart contract insurance are partly determined by the amount of NXM staked on a smart contract system – more NXM staked means cheaper premiums. Risk assessors earn staking rewards from the premiums of new covers taken out on the smart contract system that they staked on. So far 792k NXM (worth $2.2M) has been staked.

Breaking down how much is staked on each smart contract system. Risk diversification is crucial for insurance to succeed and Nexus is offering insurance for a wide variety of different dApps. For more stats see https://nexustracker.io/.

📌 PoolTogether

Contributor: Leighton Cusack, CEO of PoolTogether

PoolTogether is a prize linked savings protocol. As such, a topline metric is the amount of money in the weekly prize. Since launching the Dai pool the prize has grown rapidly, driven by:

Increases in the Dai Saving Rate

Increases in unique players contributing to PoolTogether

Increase in the average deposit size to PoolTogether.

The chart below shows the week over week increase in prize amount:

As noted above, part of the growth in prize value is due to an increase in unique players (measured by unique Ethereum addresses in the pool). This has been increasing an average of 36% week over week.

Part of the growth is also driven by an increase in the average deposit size. The later half of January saw more whales entering the pool driving up the average deposit size.

Total pool size broke $1 million Dai for the first time. Of this, ~$778,000 Dai is from player deposits and ~$250,000 Dai is sponsored.

📌 Kyber Network

Contributor: Deniz Omer, Head of Ecosystem Growth at Kyber

DeFi dapps pulling in liquidity from Kyber have increased their volumes by 87% over the last two quarters. Dapps like Fulcrum and DeFi Saver have shown especially strong growth with 499% and 284% increases respectively over the last six months. 1inch.exchange is another strong performer with continuous month-on-month growth while Nuo has seen a dip since its peak in July. (Note: volumes from DeFi integrations like Set Protocol, Dex.ag and a few others are not represented in this data as they do not have registered wallet addresses on Kyber.)

The number of new users (measured by the number of new addresses interacting with Kyber within that month) has been on a continuing growth trend since Kyber’s mainnet launch back in 2018. Within this time period a total of 52,393 addresses have carried out 633,946 trades worth 2,853,033 ETH (equivalent to $535M). Note: new address numbers above exclude users and addresses interacting directly through DeFi dapps like Fulcrum and Nuo.

Trade volumes facilitated by the top 6 reserves on Kyber increased 1,365% over the last 12 months, from $4.1M in January 2019 to $60.8M this January. Kyber’s own reserve has especially shown strong growth across ~45 different tokens it market makes for. For DAI, one of the ‘blue-chip’ tokens of the DeFi space, it is highly price competitive against Oasis with both Oasis and the Kyber Reserve supplying $17M worth of DAI trade each to Kyber in the last 3 months.

KyberSwap users come from a very diverse range of countries across the globe with users from more than 100 countries trading on KyberSwap in the last 90 days. 37% of users come from Europe, 35% from North America, 17% from Asia, 5% from Oceania, 3% from Africa, and 3% from South America. The US makes up the single largest country and accounts for just under a third of KyberSwap’s volume.

📌 Stablecoins

Contributor: Ankit Chiplunkar, Research Lead at TokenAnalyst

On-chain stablecoin volumes overtook the on-chain Ethereum volume in the middle of 2019, largely due to USDT transitioning to Ethereum. A total of $211B was transacted on-chain between Jan 2019 to Jan 2020, and on-chain stablecoin volume reached a peak of $29B in Nov 2019.

On-chain stablecoin volumes saw a significant uptick from $11B in the month of Jun 2019 to $21B in the month of Jul 2019. One notable catalyst for that increase was Binance, which transitioned from USDT Omni to USDT ERC20 in Jul 2019.

Over the last 13 months:

33% of the on-chain stablecoin volume was due to centralized exchanges. Exchange volume represents volumes related to inflow volumes, outflow volumes and intra-exchange volumes.

8% of the on-chain stablecoin volume is due to DeFi protocols. We tag a transaction as DeFi if it emits three or more events, DeFi is composability.

The remaining 57% volume is due to other use-cases, which include OTC transfers, custody management, P2P transfers. It also includes exchanges which we don't track (eg. Coinbase) and DeFi transactions which don't fit our definition.

During this timeframe, we can also see how different stablecoins are being used:

35% of on-chain volume of USDT is due to centralized exchanges and 2% is due to DeFi.

32% of on-chain volume of USDC is due to centralized exchanges and 3% is due to DeFi.

DAI leads the pack in DeFi with 86% of its volume due to DeFi transactions.

Methodology: (1) This update tracks the volumes of DAI, GUSD, PAX, TUSD, USDC and USDT. (2) The volumes of both DAI and SAI tokens are used to represent the volumes of DAI token. (3) This post currently tracks the centralized exchange volumes for the following centralized exchanges: Binance, Bitfinex, Bittrex, Kraken, Kucoin, and Poloniex

📌 0x

Contributor: Alex Kroeger, Data Scientist at 0x

Among the changes enacted in v3 of 0x is a new system of token economics. ZRX is the governance token of the 0x protocol, but it also serves additional economic functions in the ecosystem. In previous versions, the ZRX token served as the unit in which users would pay fees to 0x relayers. In practice however, there was little overlap between addresses that traded on 0x and addresses that held ZRX. This led to the proposal and approval of 0x Improvement Proposal #31, an introduction of stake-based liquidity incentives for the 0x protocol. Under this new incentive system, there is a small protocol fee associated with each trade, which are then distributed to market makers in proportion to:

the protocol fees generated from their orders

the size of their ZRX stake relative to all ZRX staked

Market makers can accrue staked ZRX beyond their own balance by creating staking “pools” and sharing rewards with third-party stakers. There is now 11.8M ZRX (~$3M) staked (source). This represents ~1.1% of the total supply and 2.9% of all ZRX holders with a balance of >1K ZRX. Around 51K ZRX were provided by market makers themselves. The rest was provided by third-party stakers, most coming in after the introduction of a frontend to interact with the staking contracts on January 9.

The stake-based incentive system also has big implications for governance of the 0x protocol. The 0x ecosystem is driving toward binding on-chain governance for the ZRX token. Under the new staking system, 50% of voting power of the staked tokens are transferred to the pool operators, the market makers themselves. So while non-market makers who have staked retain a large share of voting power (enough to cancel out the vote of the market maker if they choose), a great deal of voting power was transferred to market makers. The 11.2M ZRX currently staked is nearly double the largest amount of ZRX involved in past ZEIP votes (6.6M ZRX for the v3 protocol vote), and represents a major step forward for community participation.

In v3, every fill is accompanied by a protocol fee paid in ETH (or WETH) that is proportional to the gas price paid. While the median protocol fee is 6 cents, the distribution rises sharply near the upper tail.

One of the primary motivations for paying high gas prices for orders is to realize an arbitrage opportunity. One of the aspects of DEXs on Ethereum that makes them different from centralized exchanges is the ability of DEXs to support atomic arbitrage. This means that multiple DEX trades can be combined into 1 transaction, so when a trader sees mispricing between two DEX protocols, they can fill all the relevant orders at once. For centralized exchange arbitrage, the trader would have to communicate with each relevant exchange and fill orders separately.

This sounds great for the arbitrageur until you factor in competition. Other bots see the same trade and will race to fill the orders. What results are gas price battles to incentivize miners to include your transaction over those of other traders. Given competition, we would expect most of the arbitrage opportunity in the trade to accrue to miners in the form of gas fees.

Arbitrage trades are often not beneficial to market makers. Market makers seek to profit from a spread above the market price. The fact that an arbitrageur is taking your order often indicates that it has become mispriced. One feature of protocol fees in v3 is they result in sharing some of this arbitrage opportunity with the market makers. This, in turn, should make market makers more comfortable offering tighter spreads, since they accrue some of the arbitrage gains if their orders become mispriced.

Indeed, we see that the highest protocol fees paid thus far have been paid by contracts that we have labeled as arbitrage bots.

Our Network is a weekly newsletter where top blockchain projects and their communities share data-driven insights. Subscribe now to receive a crash course in on-chain metrics and crypto fundamentals, and never miss an issue.

About the editor: Spencer Noon leads investments for DTC Capital, a fundamentals-focused crypto fund. He actively tweets about on-chain metrics.