Our Network: Issue #51 (Part 2)

Plus — why I'm joining Variant.

Continued from Part 1.

③ Numerai

Contributor: Omni Analytics Group

Numerai has continued its march toward their goal of "managing all the money in the world" through a steady growth in the number of staked submissions, an increase in the total amount of Numeraire ($NMR) locked and the release of Signals, a platform that incentivizes the submission of machine learning-based predictions derived from novel data sources.

For what has been deemed the “classic” tournament, more than 1,000 submissions have been staked the last 2 rounds. Round over round, the 184,000 NMR currently staked in the tournament represents a 5.5% increase over the previous total. At the current rate of growth, total stakes could reach the 200k milestone by the end of Q1 2021, if not earlier.

As a recent addition to the leaderboard, staked submissions now have 52-week net return estimates to help users gauge the profitability of their statistical models. A quick glance at the distribution shows that the most active data scientists are earning a 49.4% average return on their stakes and high-performing modelers have earned well over 300% for their predictions over that same time period.

With the release of the Signals platform, Numerai has expanded the pool of contributors beyond those with machine learning expertise to anyone with access to expressive, unique stock market data. Analysts who can turn this datum into predictive signals are encouraged to submit them, along with a portion of staked NMR, to be scored on the originality and accuracy of their forecasts. These meaningful signals may be derived from quantitative data — think dividend yields and quarterly revenues, or qualitative information, such as a text mined 10-K filing and investor relations transcript. To date, there have been more than 383 submissions with over 2000 NMR consistently staked for the last four rounds.

Recently Numerai has been doubling down on community development by encouraging the creation of on-boarding tutorials and holding virtual "office hours" where tournament participants share their expertise. These efforts help support network growth and fuel interest in the Erasure-ecosystem.

④ Livepeer

Contributor: Doug Petkanics, Founder and CEO at Livepeer

December is already the highest usage month to date on the Livepeer video infrastructure network, with over 280,000 minutes of video streamed, over $2500 of fees paid by broadcasters to node operators, and over 100,000 LPT distributed to token holding network participants through staking and node operations through the first 15 days.

This usage comes via various web2 and web3 sources. The Livepeer.com hosted streaming API is serving traditional video applications, such as PlayDJ.tv (read more here), and is a great fit for user generated content applications. On the web3 side, the file.video integration between Filecoin and Livepeer serves as a template for a decentralized Youtube, and allows users to upload videos to be ingested and transcoded by Livepeer, and stored on Filecoin for long term access and playback.

An experimental performance incentive program for node operators began on Monday, December 14th, and will run for 3 consecutive 1-week rounds. It will distribute 1000 LPT/day to operators who score high enough on video transcoding success and latency across each of three streaming regions (US, EU, Asia). This is a good opportunity for GPU operators to bootstrap an initial supply of Livepeer Token and position themselves highly on the leaderboard in these regions, while also earning transcoding fees on the network.

⑤ ETH Front-Running

Contributor: Professor Aleksandar Kuzmanovic, Co-Founder & Chief Architect at bloXroute Labs

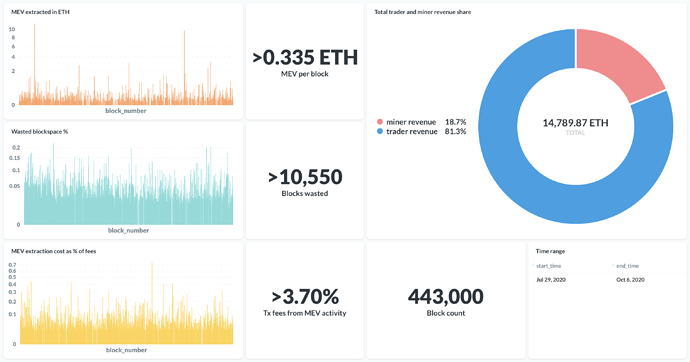

Front-running is a growing problem in the DeFi space. A recent study that aimed to quantify the so-called miner-extractable value (MEV) in Ethereum in the last 6 months shed some light on the scale of bot activity in Ethereum. The study found (figure 1) that bots extracted 0.34 ETH of MEV per block through arbitrage and liquidations. Moreover, the study found that 18.7% of MEV extracted by bots is paid to miners through gas fees which makes up 3.7% of all transaction fees. Undoubtedly, this implies that the scale of bot activity on Ethereum is becoming mainstream.

The speed by which one can send transactions to a mining pool can help, to an extent, protect against front-running. In particular, bloXroute is on average about 0.5 seconds faster than the other two providers (figure 2). Thus, when a trader is utilizing bloXroute’s service, it is more resilient to front-running.

To provide comprehensive front-running protection, bloXroute introduced a private transactions service, in collaboration with a group of mining pools, illustrated in Figure 3. The total hash-rate of the collaborating mining pools crossed 30% recently. This number is essential in determining the speed the private transactions will be mined, which we analyze in the next section. Private transactions are securely sent to collaborating mining pools and are not made public until they are mined, together with other, non-private transactions, such as TX1 in Figure 3. Private transactions allow traders to focus on their trading strategies without a fear of being front-ran.

An important issue regarding private transactions is the average time it takes for them to be mined, which depends on the proportion of the hash-rate that collaborating mining pools hold. While the number of the collaborating mining pools is constantly growing, Figure 4 demonstrates that the service is already practical. The figure shows the probability that a private transaction will be mined (y-axis) as a function of time (x-axis), considering an average inter-block time of 12 seconds. The probability that a private transaction is mined within 3 blocks (36 seconds) is higher than 80%, and within 5 blocks (60 seconds) is ~95%.