Our Network: Issue #41

Coverage on Bitcoin, Ethereum, and other L1s.

This is issue #41 of the on-chain analytics newsletter that reaches nearly 5500 crypto investors every week 📈

This week our contributor analysts cover L1 projects: Ethereum, Decred, Tezos, Bitcoin, and Cosmos.

① Ethereum

Contributor: Lucas Outumuro, Senior Analyst at IntoTheBlock

Ethereum has matured remarkably over the past three years. While ETH’s price is still down 75% from it's all-time high, Ethereum’s on-chain metrics are approaching January 2018 levels as demand for Ethereum block space and Ethereum-based dapps continue to grow. This is evidenced by the number of Ethereum transactions reaching its second-highest level on September 17, 2020 (see graph below).

Ethereum’s on-chain indicators and ETH’s price have diverged significantly since 2018. The high number of transactions relative to price is indicative of the utility Ethereum addresses derive from using the underlying blockchain, and point to a discount relative to 2017’s (over-extended) valuations. Other key on-chain metrics such as Daily Active Addresses (DAAs) exhibit the same pattern.

The number of daily active addresses used to be strongly correlated to the price of Ethereum, but this correlation has dropped year after year. The decreasing r-squared between ETH’s price and active addresses points to a lower amount of variation in address activity being explained by price movements. This is likely due to less speculative activity taking place and more ‘organic’ demand to use the Ethereum blockchain and applications built on top of it. ETH token indicators also signal positive developments and optimism amongst holders.

31.3 million Ethereum holders (67%) are currently in the money or are profiting from their positions based on the average price at which they purchased/received ETH on-chain. This number is up 10x from January 2020 when prices were roughly one-third of current prices suggesting that this year a high amount of new addresses bought at lower prices, in addition to existing holders lowering their average costs. This also means that the number of ETH addresses profiting is nearly the total amount of addresses holding BTC (31.8 million) [Source].

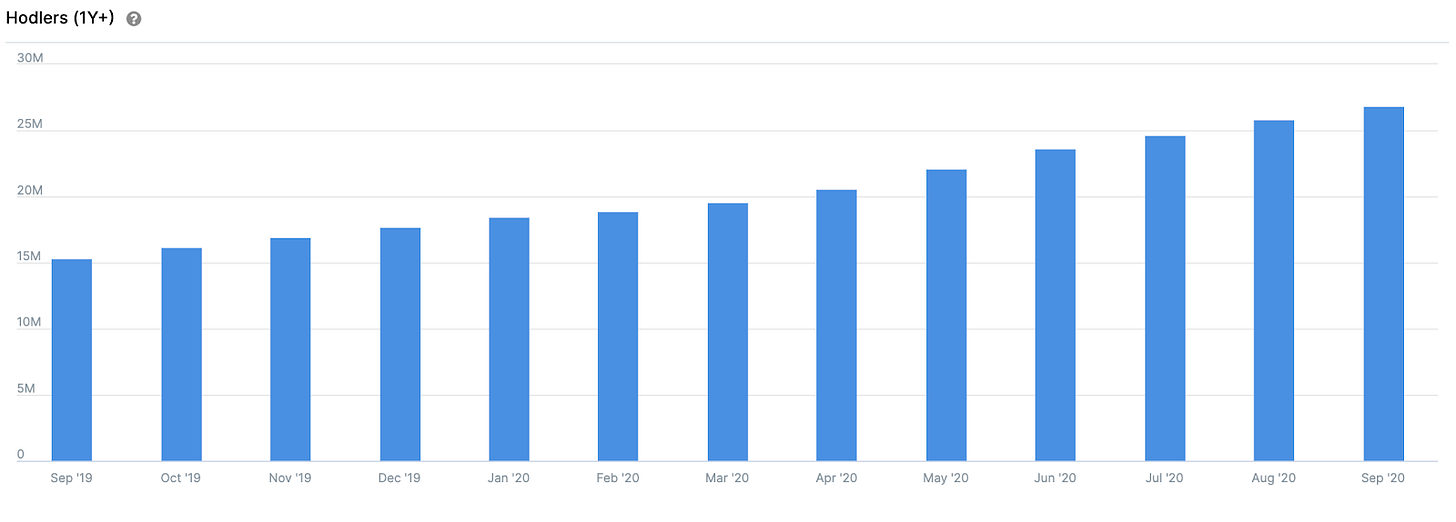

Ethereum holders are increasingly buying in ETH with a long-term investment horizon as reflected in the number of addresses that have been holding for over one year (considered as hodlers by IntoTheBlock). The number of hodlers has grown steadily over the year, even during March when prices collapsed by over 50%. Ethereum hodlers’ unwillingness to sell points to investors’ strong conviction in the asset retaining or increasing in value long-term. Ultimately, this highlights the potential of ETH as a store of value for the Ethereum ecosystem as it continues to grow.

② Decred

Contributor: Permabull Nino, Decred On-Chain Researcher

Decred is a young network in the process of bootstrapping, and with that comes heavy influence from miners in relation to price movements. The “Mining Pulse” is a tool which tracks the average network block time versus the network target of 5 minutes per block. Extremes in excess of +/- 2 seconds have historically shown periods of miner distress, and also marked historical DCRBTC tops (see red arrows). Consistent values close to zero represent “equilibrium mining”, where block times are very near the network target of 5 minutes. Equilibrium mining provides ideal conditions for reversing a downtrend, and the current mining pulse shows the network is getting closer to reaching this state (see white box in graphic above).

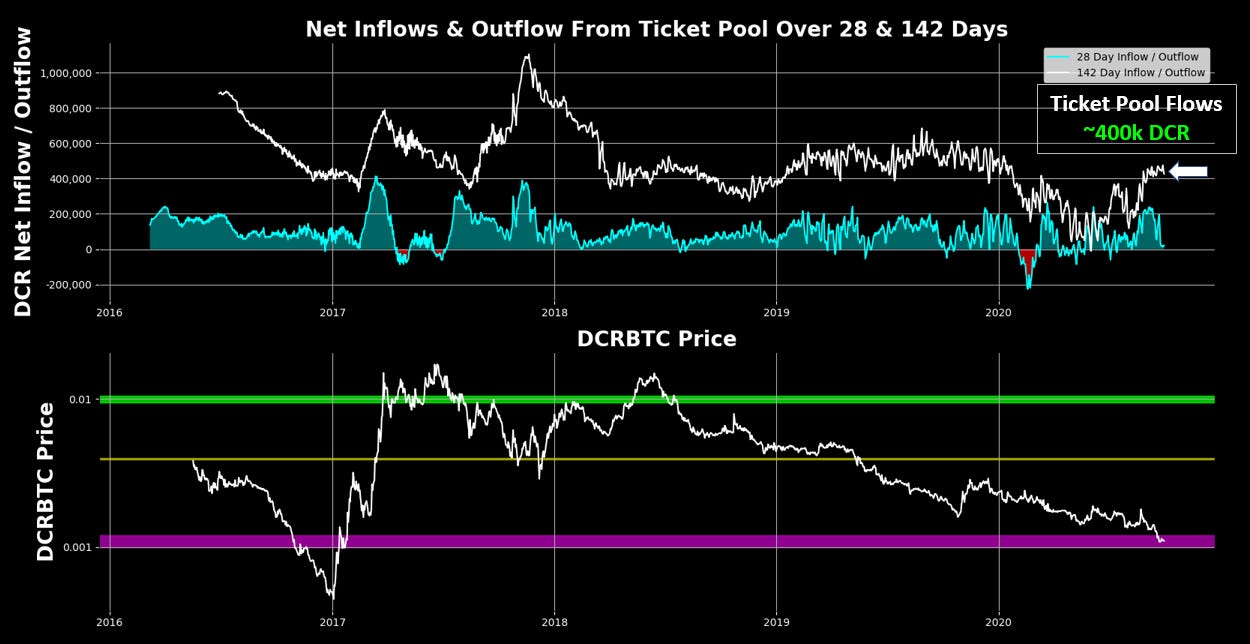

Decred is a hybrid Proof of Work + Proof of Stake network, and Decred stakers lock DCR into “tickets” to accumulate block rewards / lock in governance rights over the network. These tickets, in some respects, can tell us a lot about holder sentiment with increases in staking demand showing high sentiment (and vice versa). In early 2020, the 142-Day ticket pool inflows dropped to 0 DCR - the lowest value in the project’s lifetime and likely a signal of staker capitulation. Since then ticket pool inflows have recovered to ~400k DCR over the past 142 days, signaling that DCR capitulators’ coins have found new owners.

The Decred Treasury is the lifeblood of the project, as it funds an army of contractors (via block rewards) to build on it without depending on third parties for funding. Thus, it is important to keep the Treasury Balance + Flows at healthy levels. The current Treasury Balance sits around 640k DCR and has been around this level for most of 2020. Furthermore, for the first time in the project’s history the rolling 90-Day flows of DCR into the Treasury went negative. These negative flows seem to be in an early-stage reversal back to positive territory, with flows remaining positive after a recent contractor payday.

With a great treasury comes great...budgeting responsibility. By taking the current Treasury Balance, future Treasury block rewards, and current Treasury payment data we can budget how many months of runway the network has before exhausting its funding. As can be seen in the chart above, the current Treasury Balance is around ~$8M USD with a projected 94 months (~8 years) of runway. It’s worth noting that at peak 2017 bullish price action the Treasury had over 1,000 months (~80 years) of projected runway.

③ Tezos

Contributor: Alexander Eichhorn, Research Analyst at Blockwatch Data

Growth: The month-long uptrend in network growth measured in terms of new funded addresses has peaked together with XTZ/USD price in mid-August and has since declined considerably. As of Sep 1st, there are 60k accounts holding between 10 and 10k XTZ, still an astonishing 2.5x increase since the beginning of this year.

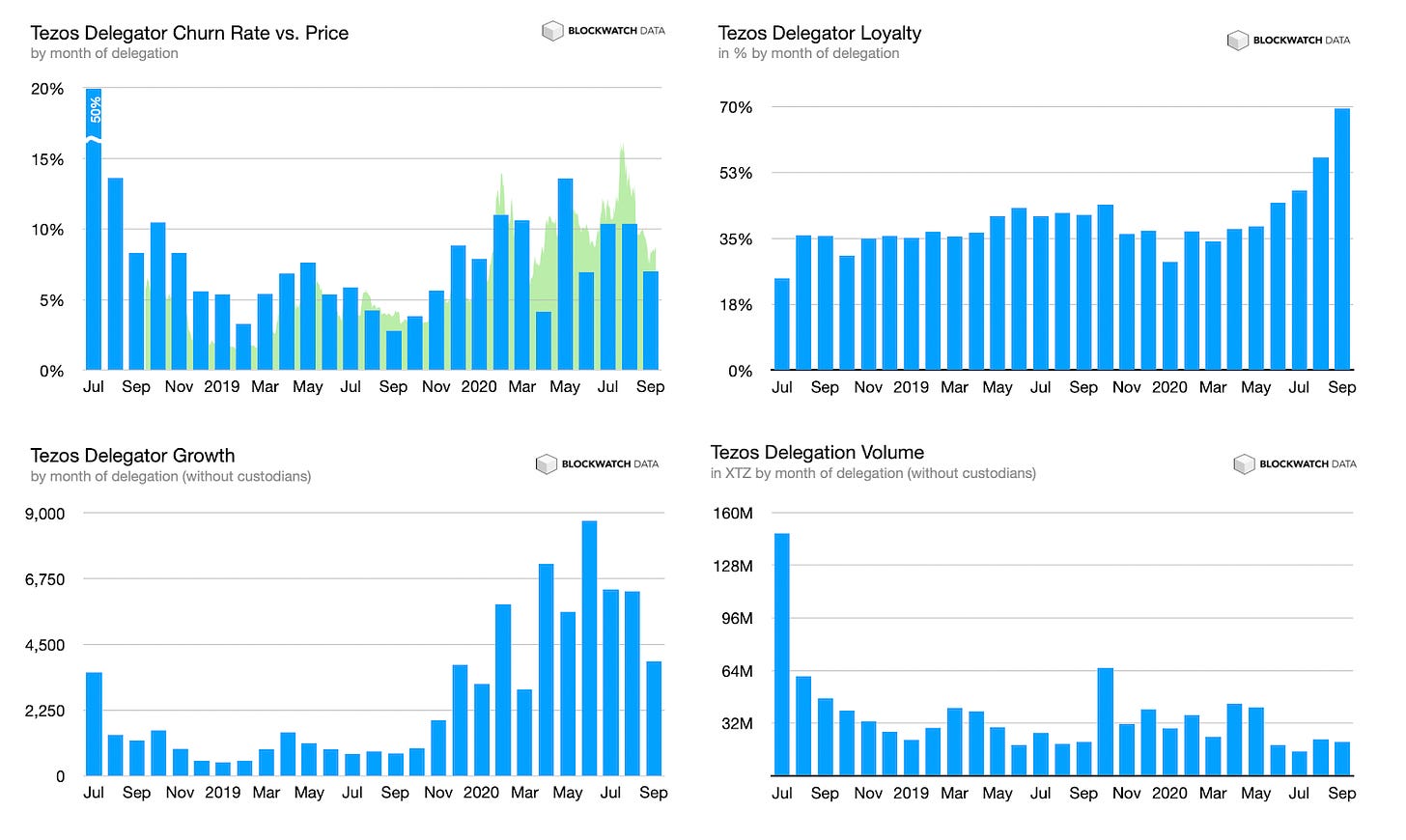

Delegator Loyalty: Like account growth, the unprecedented delegator growth on Tezos has slowed. High growth at low volume over the past year means a majority of new delegators are small investors who try Tezos delegation for the first time. Despite the 3x price increase and the equally drastic -46% price drop over the summer, delegator loyalty is unbroken and churn rates are starting to decline again.

Out of a total of the 74k delegators, 71k delegate to active bakers, about 3k to inactive bakers. 75% (55.2k) of all delegators hold more than 1 XTZ (below, we focus on this group only). Only 1% (700) are related to custodial staking. The majority of 72.3% (39.4k) public delegator accounts are loyal accumulators who re-invest payouts or top-up their balances. Only 27.7% (15k) opportunistically move or sell their stake.

Custodians: The meteoric rise of custodial staking which started with Coinbase's Staking announcement in November 2019, almost 10 months ago, has been slowing down since May. Quarter to quarter we still observe a linear increase of 10-15% across the three large players Coinbase, Kraken, and Binance. Today custodians control 25.5% (174M) of Tezos' consensus (683M, 79.3% staking ratio) and hold 20.5% of the total supply (851M).

Adoption: Tezos is slowly but steadily gaining traction. The majority of all publicly visible activity still happens on testnets (mostly on Carthagenet, but the recently launched Delphinet is warming up). It turns out that the more interesting use-cases are gas-constrained, so the network upgrade to Delphi is most welcome. Although blockspace is still cheap on Tezos (due to lack of activity), a standard swap on Dexter costs 840k gas and there is only room for 12 such swaps per block right now. That's in contrast to ~85 Uniswap swaps per block on Ethereum. Delphi is expected to improve gas cost by 4-10x.

Activity: Most of the activity on Tezos mainnet still originates from transactions on deprecated KT1 delegator contracts (mostly baker payouts sent from or to these accounts). Unsurprisingly, baker payouts contribute most to the network gas usage today. Since August, we're also seeing the first operating oracles on mainnet and just two days ago the first AMM DEX Dexter launched with two pools for tzBTC (wrapped Bitcoin) and USDtz (stablecoin) tokens. The first two days saw 1,800 transactions on both pools and right now there are 40k XTZ, 13k USDtz and 5.6 tzBTC locked.

④ Bitcoin

Contributor: Nate Maddrey, Research Analyst at Coin Metrics

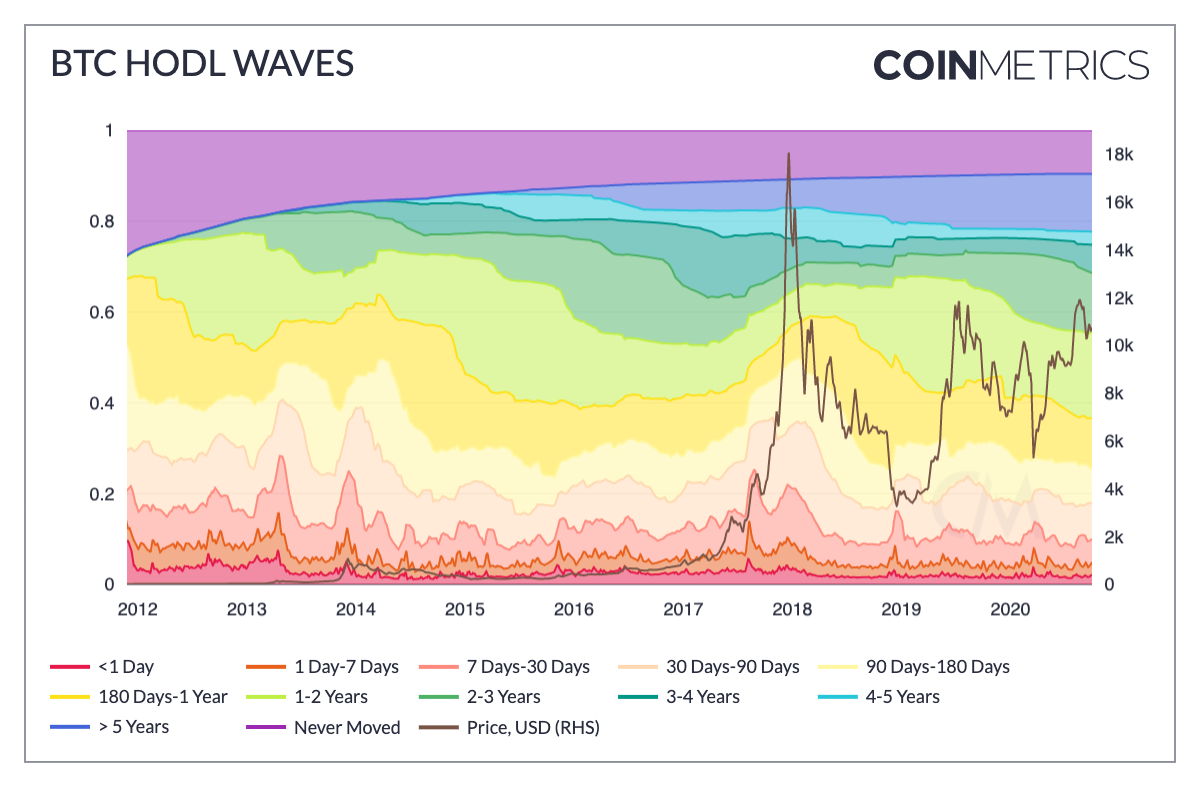

HODL waves give a macroscopic view of how BTC supply has shifted over time. Introduced by Unchained Capital in 2018, the following visualization shows BTC supply grouped by the age it was last moved on-chain. Each band depicts the percent of total supply that has been held for a certain period of time.

During periods where BTC’s price has bubbled, the short-term HODL wave bands tend to expand while the long-term bands contract. For example, when BTC price approached $20,000 in December 2017, the percent of supply held for 7-30 days reached over 12%. Historically, it's mostly stayed within the 4-6% range. In contrast, the percent of supply held for 1-2 years dipped to 7.5% in December 2017, while it has typically stayed between 10-20%. These fluctuations presumably happen because longer term holders sell some of their holdings as prices peak, while shorter term-holders increase during market frenzies.

After temporarily dipping down following the March crypto crash, the long-term supply bands have been growing over the last 3 months. This signals that BTC is likely being used as a store of value, which is a positive sign for the long-term health of the network.