Our Network: Issue #15

Updates on Bitcoin, Tezos, Cosmos, and Decred.

Editor’s Note

Our Network is live on Gitcoin Grants. We are grateful for everyone who has donated so far who believes in our mission of free crypto analytics. Right now 1 Dai donations are being matched with 33 Dai, so it doesn’t take much to move the needle for us.

Click here to learn more or make a donation, and thanks everyone for your support!

Networks

This week our contributors cover the following cryptocurrencies:

Bitcoin

Tezos

Cosmos

Decred

📌 Bitcoin

Contributor: Nate Maddrey, Research Analyst at Coin Metrics

Bitcoin has rebounded relatively well after its precipitous price drop from about $7,600 to under $5,000 on March 12th.

Although hash rate temporarily plummeted along with the price, it appears to have started growing again after hitting a local bottom. Sudden hash rate drops can be painful in the short term but can be healthy in the long term. Less efficient miners are often knocked out of the market after large price drops, but are typically replaced by more efficient miners over time.

The below chart shows Bitcoin estimated hash rate over the last year, smoothed using a seven day rolling average.

The percentage of Bitcoin untouched for at least 30 days (in other words, the percentage of the total Bitcoin supply that has not moved on-chain as part of a transaction in 30 days or longer) dropped from about 89.4% on March 10th to a low of 86.0% on March 20th. December 2018 was the last time the percentage of supply untouched for at least 30 days dipped below 86.4%.

But the percentage of Bitcoin untouched for at least 2 years has actually increased since the crash, from 41.96% on March 3rd to 42.50% on April 1st. This signals that longer-term holders have (mostly) not been panic selling, and that recent price movements are likely mostly driven by shorter-term holders.

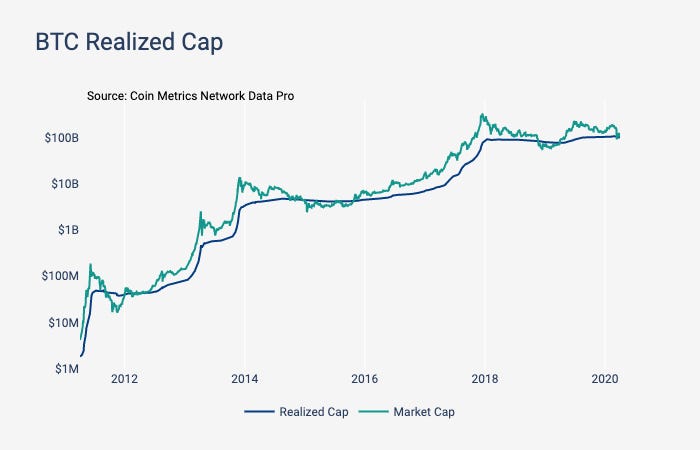

Bitcoin market cap briefly dipped below realized cap on March 12th through 18th.

Realized capitalization is calculated by valuing each unit of supply at the price it last moved on-chain (i.e. the last time it was transacted). This is in contrast to traditional market capitalization which values each unit of supply uniformly at the current market price.

Sudden changes in realized cap can signal that older coins are suddenly being moved. If market cap drops below realized cap and does not recover, it could signal that investors are increasingly underwater and unable to sell their coins without taking a loss.

But if market cap drops below realized cap and then later bounces back above it, it could be a sign that the market was oversold during that period. Historically, the periods where market cap has dropped below realized cap have been some of the best times to buy Bitcoin.

📌 Tezos

Contributor: Alexander Eichhorn, Founder at Blockwatch Data

Protocol Upgrade: With world-wide spotlight elsewhere, the Tezos community quietly focused on hardening its base layer with a third protocol upgrade (codename Carthage) that went live on March 5. Voted for by 46% of all bakers and backed by 72% of network stake the participation rate was slightly down from earlier votes (46%/84% in Athens, 45%/83% in Babylon). Like expected for a bugfix release the on-chain upgrade went much smoother this time. >85% of all bakers had upgraded their software ahead of time and baker churn was limited to <3% (down from 10% in earlier upgrades). Note that a protocol upgrade in Tezos is not backwards compatible like in Bitcoin, so all infrastructure including indexers, wallets and dapps need to follow.

Staking: Custodial staking at the top 3 exchanges Coinbase, Binance and Kraken continued its strong 2-digit growth trend during March while smaller exchanges saw almost no change. On April 1st a whopping 65.7M tez (10% of all staked coins, 7.9% of total supply) was staked at Coinbase alone. Together the top 5 custodial exchanges manage 136M tez (21% staking supply, 16.4% total supply). At these numbers monthly income from staking fees for Coinbase should be around 82.5k tez ($140k USD).

Growth: Month over month growth slowed down during March to about +6% (25k accounts) with the strongest growth in the account range between 100 and 1000 tez (+2k, +20%). With custodial staking on the rise centralization grows and the top 1k accounts now hold 64% of total supply with the Gini index for balances > 1 tez sitting at 0.9647. Large accounts with balances between 10k and 1M were in decline, while exchanges and a few whales are continuing to accumulate. 6% of total supply (50M tez) was on the move last month while 77% of supply haven't moved since 3 months ago.

Staking: 3.3M new tez were minted last month, network wide staking ratio dipped back 1.2% to 78.5%, staking rewards are at 6.07% annually, future expected yield above inflation increased slightly to 1.3% (note: we changed the way we calculate yield since last newsletter). At first sight it seems as if the downtrend in price from mid February heights could have caused delegators and bakers to liquidate some of their stake.

A closer look at the data reveals, however, that the opposite happened. Total delegated supply (the part of staking supply that is not owned by bakers) actually reached an ATH of 522M towards end of March. Reason for the network staking dip was baker churn. Around 3% (10M staking supply owned by bakers and another 7M delegated to them) went inactive during March.

Adoption: With nearing end of live for the Babylon testnet, dev teams are slowly migrating over to Carthagenet. Both testnets combined we see a continued growth in developer activity (+10% calls) and a strong increase in contract diversity (+34%). Clusters of activity on testnets appear to be around new token designs and STO product demos which is very encouraging.

Smart contract activity on mainnet is still stagnant in terms of traffic and gas. However, real value in blockchains does not necessarily hide behind lots of traffic. StakerDAO actually passed their 3rd on-chain vote, and the first STO token backed by a real-world asset (a french music pavilion) was released by Equisafe in early March. Despite its value and fame, calls to such a contract are extremely rare so real impact for Tezos and the blockchain industry is hard to quantify using on-chain data alone.

📌 Cosmos

Contributor: Chjango Unchained, Director of Community at Cosmos

Inter-blockchain Communication (IBC): IBC is the flagship digital asset and data transfer protocol for communicating value across bespoke blockchains. When IBC is launched in a few months' time, it will usher in the era of an Internet of Blockchains—a watershed moment that will benefit the entire industry because it would bring about what I liken to the Industrial Revolution for the macro crypto economy. Today, IBC is nearing production-readiness and is being stress-tested in a testnet environment.

Source: https://ibc-relay.herokuapp.com/

This visualizer shows you the number of established IBC connections there are between any two IBC-enabled Cosmos SDK blockchain which, once connected, start relaying IBC packets between one another.

There are currently 8 separate Cosmos SDK-based testnets (e.g. Dokia, Ping IBC, Iris, etc.) that have established IBC connections to each other's testnets and are transporting IBC messages to one another across chains. Image 2 isolates Dokia's testnet chain and shows that it has 25 connections established to allow it to "trade" data/value/etc. with the economies of the other chains.

Metaphorically, it helps to think of each IBC connection as a highway or even a trade route, a relayer as any untrusted vehicle (you don't need to trust the relayer in order to be sure that the contents in the package were not tampered with) that delivers payloads (e.g. smart contract calls, tokens, location data, etc.) from chain A to chain B, and finally, a bespoke chain as a sovereign economy that wishes to embark in trade with another chain's economy. Put it all together and what do you get? Globalization as the end-state for token economies.

Game of Zones (GoZ): Incentivized testnets were a thing pioneered by Cosmos in 2018. Game of Stakes (GoS) was the first of its kind which subsequently spurred the creation of at least 11 other incentivized testnets since its inception, including that of Cardano, Solana, Near, Oasis, Irisnet, Celo, Matic, Icon, Lino, Coda, and Nucypher, to name a few.

Game of Stakes was necessary for preparing for the Cosmos Hub launch to ensure that no critical vulnerability would break the mainnet. This year, GoZ is the sequel to that for stress-testing IBC before we dive, head first, into a high-stakes connected multi-chain world. This year, participants are going to be spinning up relayers and racing to drive the most IBC packets across federated testnets for GoZ.

The GoZ topology will look something like this:

Source: https://goz.p2p.org/

Participate in the Game of Zones: https://goz.cosmosnetwork.dev/

Cosmos Governance: The Cosmos Hub community tax pool had been slowly accumulating ATOMs since the launch of the mainnet to having over 340 thousand ATOMs. At the end of January 2020, the very first community spend vote was passed: Prop 23 (source)

Prop 23 stated that it would pay 5250 ATOMs to instantiate a Cosmos Governance Working Group. It passed with ~91% Yes in which 63% of the voters were validators while the other 37% of the voters were non-validating ATOM holders who overrode their validators' vote.

In Cosmos, there is a semi-liquid democracy whereby votes are by default cast by validators and individuals with voting power inherit the votes of the validators they're staked with. However, if individuals choose to cast their own votes, they can override their validators' votes, which is what we have seen happen with this proposal. Because of this governance feature, Cosmos governance differentiates itself from representative democracies as seen in DPOS protocols like EOS.

Staking Amidst Market Crash: March was a tough month for everyone. If we rewind to February 2, 2020, we saw peak staking in the network at 187 million ATOMs. It fell by 4% six weeks later, just two days after the entire crypto market took a nosedive on March 16th following Bitcoin's lowest price point since 2017. Bitcoin, Gold, and the DJIA were all of a sudden correlated. But because Bitcoin movement informs all the rest of the token economy's movements, ATOM, like comparable POS protocols (e.g. EOS, Tezos), took 69% haircuts ubiquitously. Network staking levels:

Source: http://cosmos.fan/#/data

Because it takes 21 days, or 3 weeks, to unbond ATOMs, you can see the first wave of people who undelegated at the first trough on January 28th. The second lower trough came exactly 3 weeks later on March 17th, where the ATOM price hit its year-to-date all-time-low to $1.55—a 69% dump. One can only infer that those first wave of undelegators were the ones who sold off to the bottom of the market.

📌 Decred

Contributor: Checkmate, Decred contractor

The past month of price action in the cryptocurrency markets has been extreme, with Decred price action being no exception. This week we look at a number of key metrics which have reached extreme values, often associated with the formation of price bottoms, reflexivity, and mean reversion.

The first metric is the Stock-to-Flow model which was developed by the author. This model considers a log-log regression fit between daily values of Market Cap and the Stock-to-flow ratio of the DCR supply. The S2F Multiple is also shown which functions as an oscillator, indicating when network valuation has become over/undervalued relative to the S2F 'fair value' model. Following the price drop on 12/Mar, the DCR S2F multiple has entered the historical low zone last seen in Jan 2017.

The next chart shows the statistical distance between the Decred Market Cap and the predicted S2F model valuation, measured in standard deviations. For reference, an equivalent S2F model for Bitcoin is shown, with some interesting similarities in the fractals playing out in Decred's price discovery.

It can be seen for both networks, that as network value approaches ~2x standard deviations from the prediction, price tends to snap back towards the mean. For Bitcoin, this generally coincides with halving events, a shock to S2F value and scarcity. For Decred, this is more closely associated with oversold conditions since the smooth issuance curve is less variable than Bitcoin's.

An on-chain metric developed by @permabullnino is the 142-day sum of all USD value bound in Decred tickets. DCR coins bound in tickets are indicative of strong demand for holding DCR long term. This metric (red line) has shown to act similar to an upper bound Bollinger Band as resistance during price discovery.

By taking Fibonacci multiples (23.6%, 38.2% and 61.8%) of the 142-day ticket sum, additional trading ranges and boundaries have been identified. In particular, the 23.6% Fibonacci multiple (green line) has provided lower bound support throughout bull and bear cycles. In the 12/Mar market sell-off, price pierced below this level before rapidly bouncing back into the range.

Decred ASIC miners have endured very challenging market conditions after ASIC hardware was first released in Jan 2018, at the peak of the alt-coin market cycle. Given miners are long term thinkers and investors, the Puell Multiple provides insight into whether income streams are profitable or not and the level of stress in the hash-power network.

The Puell Multiple takes the ratio of daily PoW USD income to its 365day average. This provides a view of today's income relative to the past year. Similar to the metrics shown above, the Puell Multiple is approaching an extreme value commonly associated with the proverbial event where 'miners put the bottom in'.

The Decred DEX is currently under development and is aiming to provide trustless exchange between crypto-assets via atomic swap technology. On Wednesday this week, Decred DEX server client successfully coordinated its first trustless exchange between DCR and BTC on test net.

The DEX swapped 42 DCR for 0.42 BTC with an output from bitcoin-core testnet below showing successful receipt of the coins. Full transaction details of the atomic swap are found here for those interested in the inner workings (https://gist.github.com/chappjc/6c5bc6d9244e02249b867e8fe76e4762).

Subscribe to Our Network for free crypto insights every week:

About the editor: Spencer Noon leads investments for DTC Capital, a fundamentals-focused crypto fund. He actively tweets about on-chain metrics.