EXCLUSIVE ONCHAIN COVERAGE:

Data Protocols 📊

① Chainlink ⛓️

👥 LinkPool | Website | Dashboard

📈 Chainlink CCIP requests and fees are surging in 2024; fees up +311.95% and requests up 953.9% month over month in March

LinkPool is one of the largest Chainlink node operators in the Chainlink Ecosystem that builds open-source tools & onchain analytics. Lately, efforts have focused on publishing data analytics pertaining to Chainlink Cross-Chain Interoperability Protocol (CCIP), which enables Web3 to securely send messages, transfer tokens, & initiate actions across blockchains. A single, elegant interface for all cross-chain use cases. CCIP usage and fees have seen a meteoric rise quarter over quarter.

Zooming in on Total Requests: activity on Arbitrum, Optimism, & Base lead the quarter over quarter, month over month growth. Arbitrum in March especially holds the crown showing a +669.72% increase in Total CCIP Requests & is either the leading source or destination chain of all CCIP requests.

Total Requests in April show the momentum of CCIP usage continues to accelerate. With just over 1/4 of the way through the month, April Requests currently stand at 46.549% of all requests made in the month of March (72.5k in March vs. 33.7k April), showing another record-breaking month in the works.

💦🔬 Tx-Level Alpha: In this transaction, 1M USDC was transferred from Arbitrum to Base by cross-chain swaps protocol XSwap, powered by CCIP. Best put by XSwap, "High-volume transactions are the first step in onboarding financial institutions to web3, thanks to the use of CCIP from Chainlink." Bridging exploits have accounted for 44% of all Web3 exploits ($2.8B in total), & thanks to CCIP, Web3 now has a safe & secure interoperability solution that enterprises and institutions require to deploy capital onchain.

② The Graph 🧑🚀

👥 Ricky Esclapon | Website | Dashboard

📈 The Graph’s decentralized network crosses 1.5B+ in quarterly query volume, +66% quarter over quarter growth

The Graph provides critical web3 data infrastructure, allowing users to organize and retrieve the blockchain data they need. Query volume on the network has gone up for the fourth consecutive quarter, passing the 1.5B threshold (and the 1B threshold for the first time 🎉).

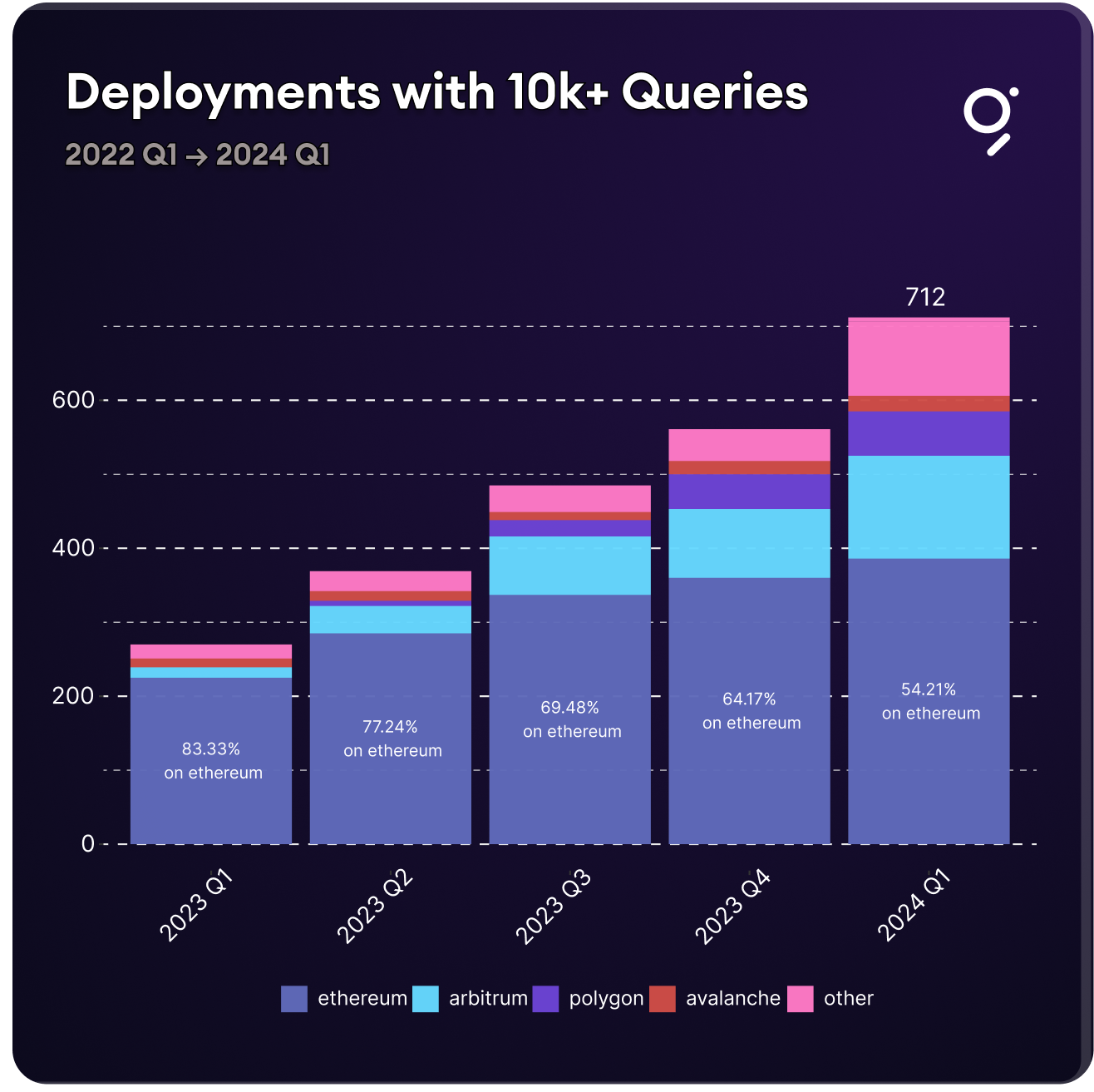

The number of queried subgraph deployments on the decentralized network keeps growing every quarter, and in Q1 reached 712 subgraph deployments that had at least 10k queries. The percentage of those indexing non-ethereum has kept increasing as more chains are adopted (now 40+ chains).

The amount of subgraphs created on the decentralized network has increased for the fourth consecutive quarter, and is up +114% compared to the previous quarter. The proportion of subgraphs deployed to L2 has increased for the past 5 quarters and was over 96% for Q1.

③ Pyth 🔮

👥 Anthony Loya | Website | Dashboard

📈 Pyth Network crosses $1B+ in staked $PYTH, 167k+ stakers

Pyth Network is expanding its multi-chain ecosystem with over 490+ real-time price feeds, covering a diverse range of asset classes including cryptocurrencies, equities, foreign exchange (FX), rates, and metals. Here you can dive deeper into the diverse feeds Pyth offers. Pyth has 406 upcoming distinct price feeds across multiple chains.

The diverse ecosystem translates into the market with $1.1B in $PYTH staked. That figure has grown 24.93% over the past 30 days. Price has also grown 23.19% to $0.85 from $0.69 in that same period. Overall, since January, there’s been healthy growth in price, staking, and average monthly volume. The average monthly volume is $221M.

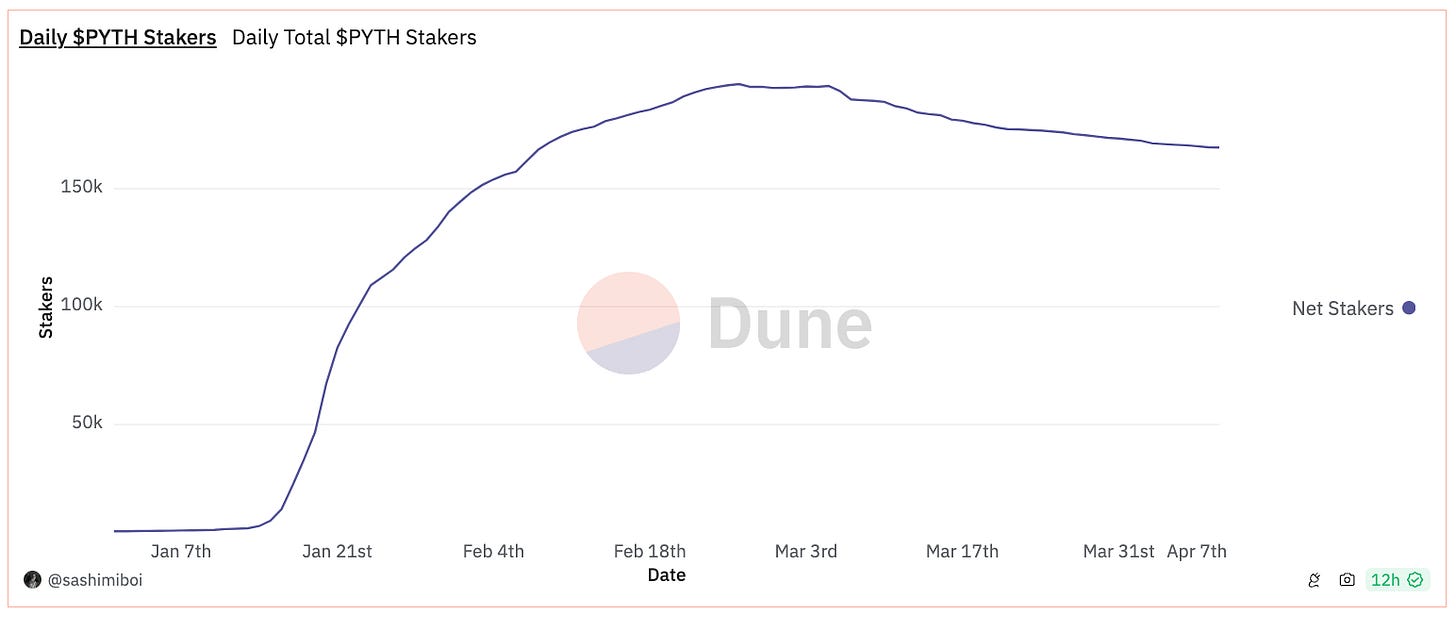

$PYTH has had 167k+ net stakers & 240k+ total unique stakers since Jan. 14th, 2024. The average staked amount per user is ~$1,955. Stakers ramped up from January to March and have slowly come back down from March to April.

💦🔬 Tx-Level Alpha: This account staked $94,609 on Apr. 3rd, 2024. There have also been numerous 6-figure stakes of PYTH going into April which suggests that the sentiment surrounding Pyth is strong. Though the number of stakers has slowly shrunk to 167k in recent months the total amount staked has grown significantly past the $1B mark in that time.