EXCLUSIVE ONCHAIN COVERAGE:

Building on Bitcoin 🏗️

① Stacks 🟧

👥 Rick Sebastiaan | Website | Dashboard

📈 Stacks Crosses 1M Wallets & 85% Increase in Active Users QoQ

Stacks is a Bitcoin L2 that enables smart contracts and decentralized applications to use Bitcoin as a secure base layer. The 2024 Nakamoto release will bring faster speeds as well as transactions that are as irreversible as Bitcoin’s once confirmed. Leading up to 2023, Bitcoin L2s took over as a key narrative in crypto, with Stacks' monthly users skyrocketing from 16,000 in November to over 64,000 in December and not dropping below 50,000 ever since.

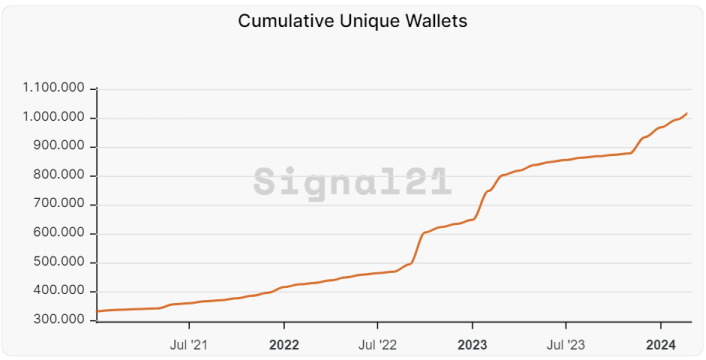

Leading up to the highly anticipated Nakamoto Release, Bitcoin L2 Stacks reached the milestone of 1,000,000 unique wallets for the network. This spike in new wallets, growing over 16% in just four months, highlights an increasing interest in building on top of Bitcoin.

As a consequence of the Bitcoin builders renaissance, new apps such as Zest Protocol, StackingDAO, and Bitflow saw Stacks' TVL in apps peak to over $150M in March, while ALEX became the number one Bitcoin L2 app in TVL.

💦🔬 Tx-Level Alpha: Bitcoin L1 transactions are slow by design and can become costly when new use cases like Ordinals and BRC-20 emerge. These new developments showed that scaling solutions are crucial in order to bring Bitcoin to the masses. This transaction shows how BRC-20 tokens move into the Stacks L2 via DeFi app ALEX, so that they can be traded on a scalable L2. This is while still leveraging the security of Bitcoin, showing what L2s can accomplish for the main chain.

② BTC in Safes 🔐

👥 Peter Liem | Website | Dashboard

📈 $448M worth of BTC stored in Safe wallets as ERC-20 tokens

Safe{Wallet} is the most trusted multisig wallet and platform to store digital assets on Ethereum and popular EVM chains for users, companies, funds, developers, DAOs and investors. There are currently 7.4M Safes. To date, a total of $118B worth of assets are being stored in Safes across 9 chains. 4% ($4.7B) of these assets comprise of native ETH with 92% of these ETH assets on the Ethereum chain. The rest of the $113B (96%) worth of assets are ERC-20 tokens. Ethereum remains the biggest chain ($59B), followed by Optimism and Avalanche at $24B and $21B respectively.

Since Feb. 1 2024, the amount of Bitcoin (in the form of ERC-20 tokens as WBTC, tBTC and renBTC) stored in Safes had increased by 50% from 4,444 to 6668 in Mar. 17 2024. The biggest driver for the BTC increase during that period is Binance’s BNB Chain, which had a ~17X increase in BTC tokens stored in Safes.

Over the past year, Ethereum had its market share of BTC in Safes decrease from 95% to 86% before sharply dwindling down to 60%. This was largely due to BNB Chain's increased inflow of BTCB, a wrapped version of Bitcoin, from Feb. 2 2024 onwards, where users added 2020 BTCB into Safes.

💦🔬 Tx-Level Alpha: At the time of Bitcoin resurgence (from Feb. 1 2024), a Safe transaction removed a liquidity position of wstETH and tBTC. The Safe had received 0.9 BTC worth $63,655. This shows one of the example where Safes are used by liquidity providers to manage their BTC assets during liquidity events.

③ ALEX 🔗

👥 Signal21 | Website | Dashboard

📈 ALEX Bitcoin DeFi Protocol Expands TVL to $78M, Achieving 121% MAU Growth in Q1

ALEX is the leading DeFi protocol on Stacks and Bitcoin. Regarded as a Super App, it features lend/borrow, Automated Market Making (AMM), Bitcoin bridges, Bitcoin oracles, BRC-20 order books and other innovations. ALEX serves as a comprehensive Bitcoin DeFi solution, and since December 2023, ALEX has experienced remarkable growth. Its Total Value Locked (TVL) surged 91% year-to-date, reaching $78M, making it the largest Bitcoin DeFi protocol, surpassing Sovryn's $72M TVL.

Average monthly active users of ALEX have surged by 121% in Q1 2024, reaching over 11,500 per month. At present, they are projected to exceed 12,000 for March, achieving a new all-time high.

Monthly transactions increased by 30% in Q1 2024, with ALEX's user base propelling approximately around 80,000 monthly average transactions. Since its 2022 launch, ALEX has facilitated over $1.2B in cumulative trading volume.

💦🔬 Tx-Level Alpha: A standout feature of ALEX is its Bitcoin bridge, facilitating seamless BTC utilization from Bitcoin L1 to Stacks L2 by minting aBTC. This enables BTC holders to utilize their assets in multiple ways, such as generate yield through liquidity providing before bridging back to native BTC. For instance, in this transaction a user bridges 0.0005 BTC via the ALEX bridge to mint 0.0005 aBTC.

④ BTC.b 🔵

👥 Ali Taslimi | Website | Dashboard

📈 BTC.b supply surpasses ₿4.1k with over 700k holders across six blockchains

Borderless Bitcoin (BTC.b) utilizes the LayerZero OFT standard to seamlessly integrate Bitcoin with all supported networks. Although accessible across various blockchains, only Avalanche's DeFi protocols have fully integrated BTC.b into their products. After over a year since its inception, the fact that Avalanche holds 99% of the token supply underscores the unsuccessful attempts to establish an omnichain fungible Bitcoin.

Despite Avalanche holding the majority of the BTC.b supply, Polygon, BSC, and Arbitrum also have a substantial number of holders, though with fewer BTC per holder on average. Consequently, the number of transactions involving BTC.b is high on these blockchains.

In contrast to other chains, over half of the BTC.b supply on Avalanche is held by DeFi protocols, namely AAVE, BENQI, and GMX. This indicates the dominance of protocol-level holdings relative to individual ownership on other networks.

💦🔬 Tx-Level Alpha: This transaction demonstrates the transfer of BTC.b tokens from Avalanche to Polygon by an address through Borderless Bitcoin bridge. The process involves transferring the BTC.b to LayerZero's proxy address, where it's burned, then minted on the new chain before being sent to the recipient.